Deposit insurance indirectly helped to create the savings and loan crisis in the United States because

A) depositors were not concerned with the types of investments made because they were insured, while at the same time savings and loans were aggressively investing in risky projects.

B) depositors, believing that the government would not secure their deposits, were very concerned with the types of investments made at savings and loans.

C) the government, without warning, eliminated deposit insurance for savings and loans, thereby causing a run on these institutions.

D) depositors were not concerned with the types of investment made because savings and loans were making very conservative investments.

A

You might also like to view...

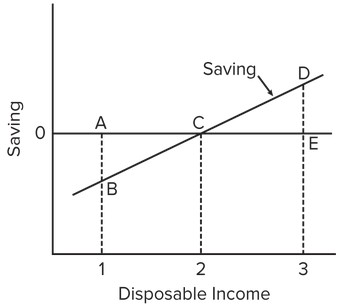

Use the following saving schedule to answer the next question.  As income falls from level 3 to level 2, the amount of

As income falls from level 3 to level 2, the amount of

A. dissaving increases. B. saving increases. C. dissaving decreases. D. saving decreases.

The market where borrowers obtain funds from savers is referred to as the:

A) capital market. B) exchange market. C) spot market. D) credit market.

One timing problem with fiscal policy to counter a recession is an "operational lag" that occurs between the:

A. end of the recession and the time it takes to recognize that the recession has ended. B. time fiscal action is taken and the time that the action has its effect on the economy. C. time the need for the fiscal action is recognized and the time that the action is taken. D. start of the recession and the time it takes to recognize that the recession has started.

You would think that if people’s income increased over time, then all industries in the economy should benefit equally, but this is not the case. Explain why and give examples

Please provide the best answer for the statement.