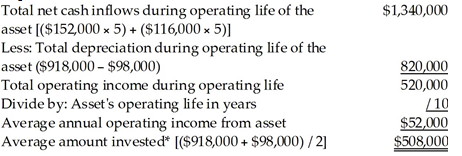

Prescott Corporation is considering an investment in new equipment costing $918,000. The equipment will be depreciated on a straight-line basis over a ten-year life and is expected to have a residual value of $98,000. The equipment is expected to generate net cash inflows of $152,000 for each of the first five years and $116,000 for each of the last five years. What is the accounting rate of return associated with the equipment investment? (Round your answer to two decimal places.)

A) 10.95%

B) 11.34%

C) 9.05%

D) 10.24%

D) 10.24%

*Average amount invested = (Amount invested + Residual value) / 2

ARR of Equipment = Average annual operating income / Average amount invested

ARR = $52,000 / $508,000 = 10.24% (Rounded)

You might also like to view...

After training, ______ evaluations are designed to determine whether or not the trainee’s on-the-job behaviors changed as a result of the training.

A. emotional B. career C. behavior D. ability

Service delivery is shifting to arm's length transactions for many services due to advances in telecommunications

Indicate whether the statement is true or false

________ is not a function of organizational culture.

A. Social system stability B. Organizational identity C. Diversity management D. Sense-making E. Collective commitment

Describe Psychology Professor Mihaly Csikszentmihalyi’s Polarity of Creative Individuals.

What will be an ideal response?