Asset inflation tends to hurt those who save in risky assets.

Answer the following statement true (T) or false (F)

False

During asset price inflation, people who bet on risky, rising asset prices are helped and those who did not are hurt.

You might also like to view...

Which best describes a credit default swap?

A) It is designed to reduce interest-rate risk. B) The issuer receives payments from the buyer in return for agreeing to make payments to the buyer if the security goes into default. C) Issuers are taking out insurance in case of default. D) It represents a way for the issuer to establish its creditworthiness.

If the spending multiplier is equal to 5, then a $1 initial increase in investment spending will lead to a:

a. 5 percent decrease in real GDP. b. 5 percent increase in real GDP. c. $5 decrease in real GDP. d. $5 increase in real GDP. e. 0.05 percent increase in real GDP.

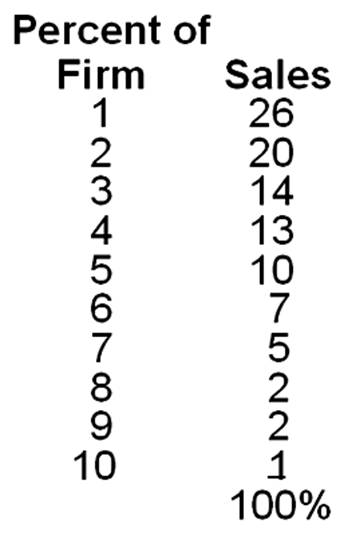

Given the information in the table below, calculate (a) the concentration ratio; and (b) the Herfindahl-Hirschman index.

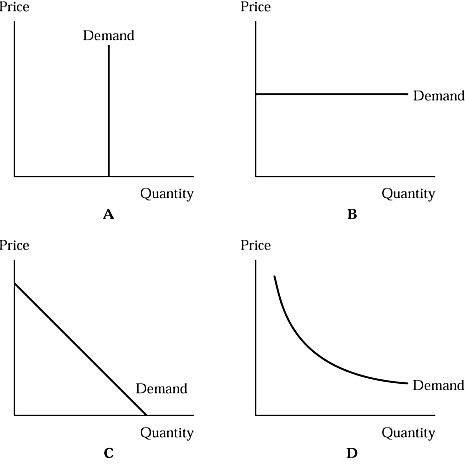

In Figure 4.1, the demand curve that has a zero elasticity is show in graph:

In Figure 4.1, the demand curve that has a zero elasticity is show in graph:

A. A. B. B. C. C. D. D.