If a taxpayer purchases taxable bonds at a premium, the amortization of the premium is elective. However, if a taxpayer purchases tax-exempt bonds at a premium, the amortization of the premium is mandatory. Explain this difference in the treatment

If mandatory amortization were not required for tax-exempt bonds, a taxpayer who held such bonds to maturity would have a recognized loss to the extent of the premium. This is not consistent with the rule that interest earned on the bonds is tax-exempt. Mandatory amortization, therefore, results in the adjusted basis of the bonds ultimately being equal to the maturity value. Thus, no loss results upon maturity. Furthermore, the amortization of the premium on tax-exempt bonds is not deductible.

For the taxable bonds and if the taxpayer does not elect to amortize the premium, a recognized capital loss results to this extent at maturity. Typically, the taxpayer will elect to amortize the premium so that it can be claimed over the life of the bond as an ordinary (rather than capital) deduction.

You might also like to view...

Explain break-even pricing

What will be an ideal response?

Answer the following statements true (T) or false (F)

1. Treating some followers better than others is a failure to meet the challenge of information management. 2. Servant leadership is accepted by members of many different cultures. 3. Servant leaders rely on positional power when making decisions. 4. Impulsive, selfish people are often identified as leaders by others. 5. Toxic followers make toxic leadership possible.

In a perfectly competitive labor market:

A. Employees can never be paid below a subsistence level (i.e., they will always be able to make enough money to survive). B. No one can be made better off without making someone else worse off. C. Employers can never make so little profit that they go out of business. D. Both employer and workers will make enough money to survive.

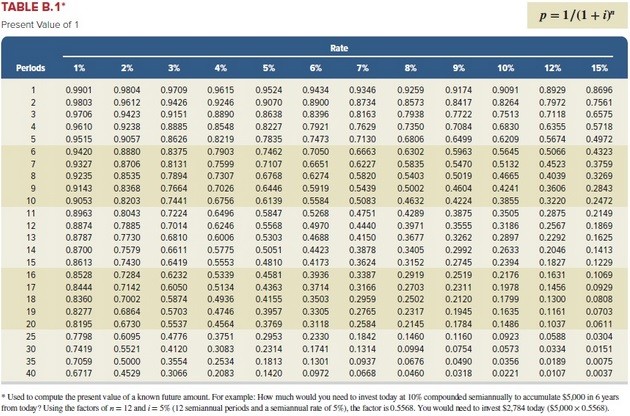

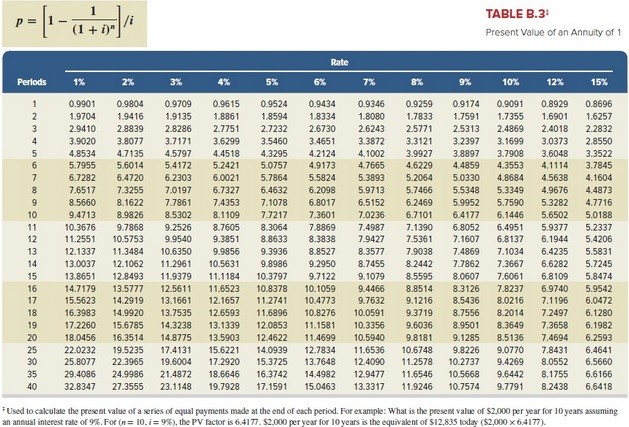

An individual is planning to set-up an education fund for his grandchildren. He plans to invest $13,500 annually at the end of each year. He expects to withdraw money from the fund at the end of 9 years and expects to earn an annual return of 7%. What will be

An individual is planning to set-up an education fund for his grandchildren. He plans to invest $13,500 annually at the end of each year. He expects to withdraw money from the fund at the end of 9 years and expects to earn an annual return of 7%. What will be

the total value of the fund at the end of 9 years? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) A. $232,723. B. $121,500. C. $67,168. D. $161,703. E. $87,955.