The current indirect exchange rate is 12 pesos per dollar. The cash inflow in pesos is 100,000 in two years and the discount rate is 10%

During this time, the anticipated annual inflation rate is 6% in the United States and 14% in Mexico. What is the present value of the 100,000 pesos in U.S. dollars after conversion from pesos to dollars if you are using current and forward exchange rates?

A) $5,984.35

B) $5,954.36

C) $5,924.46

D) $5,936.54

Answer: B

Explanation: B) First, we compute the forward exchange rate:

12 pesos per dollar × = 13.879672 pesos per dollar.

Second, we convert all pesos into dollars using the forward exchange rate:

= $7,204.78.

Third, we discount the dollar cash flow at the home discount rate:

= $5,954.36.

You might also like to view...

The maker of a note recognizes a note payable on the balance sheet and interest expense on its income statement

a. True b. False Indicate whether the statement is true or false

A company should only apply the revenue recognition standard to contracts that meet all of the following criteria except

A) the contract has commercial substance. B) collectability of consideration is probable. C) each party's rights regarding goods and services to be transferred are identified. D) the transaction price is fixed and determinable.

The most frequent use of EDI is in making vendor payments

Indicate whether the statement is true or false

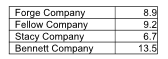

Which of the above companies has the highest debt-paying ability?

The times-interest-earned ratios of four companies are given below:

A) Forge Company

B) Fellow Company

C) Stacy Company

D) Bennett Company