Happy Clicks, Inc uses a predetermined overhead allocation rate of $5.50 per machine hour. Actual overhead costs incurred during the year are as follows:

Indirect materials $6,700

Indirect labor $2,200

Plant depreciation $47

Plant utilities and insurance $9,800

Other plant overhead costs $12,400

Total machine hours used during year 7,600 hours

What is the amount of manufacturing overhead cost allocated to Work-in-Process Inventory during the year?

A) $38,747

B) $8,900

C) $29,847

D) $41,800

D .

You might also like to view...

The various methods, rules, practices, and other procedures that have evolved over time in response to the need to regulate the preparation of financial statements are called __________________________________________________

Fill in the blank(s) with correct word

People with high self-esteem may avoid situations that make them uncomfortable

Indicate whether the statement is true or false

Which of the following statements about mobile home insurance under the ISO program is true?

A) The mobile home is insured on a replacement cost basis, but actual cash value coverage can be added by endorsement if it is more appropriate. B) There is no coverage available for "other structures." C) Built-in, permanently attached furniture is considered personal property. D) Personal liability insurance is not part of the coverage available to mobile home owners.

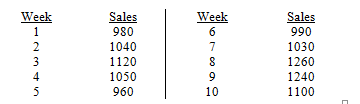

Weekly sales of the Weber food processor for the past 10 weeks have been as follows:

a. Determine, on the basis of minimizing the mean square error, whether a three- or four-period simple moving average model gives a better forecast for this problem.

b. For each model, forecast sales for Week 11.