Drivers Harris and Stein live in a state having no-fault auto insurance. Stein causes an accident by hitting Harris's car. Stein is not hurt. Harris spends three days in the hospital at a cost of $5,300 . Compute the amount each driver's insurance company pays toward medical expenses

Harris's company: $5,300 . Stein's company: $0

You might also like to view...

Daylen and Daven had totally different childhoods. Daylen was raised in a supportive environment, and Daven was raised in an abusive, neglectful environment. Daylen always scored about fifty points higher than Daven on cognitive ability tests when they were in school. After graduation, they both were hired by the same company for the same occupation. Now, five years later, what would be the most likely result if they both took a cognitive ability test?

A. Daven would narrow the scoring gap with Daylen because environmental influences on cognitive ability tend to decrease as people age. B. Daven would score more than fifty points less than Daylen because the test would remind him of the last time he took the test and his abusive childhood. C. Daylen would still score about fifty points higher than Daven because ability remains relatively stable over time. D. Daylen would score less than Daven because cognitive ability test scores are based on improvement over previous scores. E. Daven would outscore Daylen because adult cognitive ability is inverse to childhood cognitive ability.

Get Out Of Town Vacations Signed A 12%, 10-Year Note For $151,000. The Company Paid An Installment Of $2,200 For The First Month. What Portion Of The First Monthly Payment Is Interest Expense?

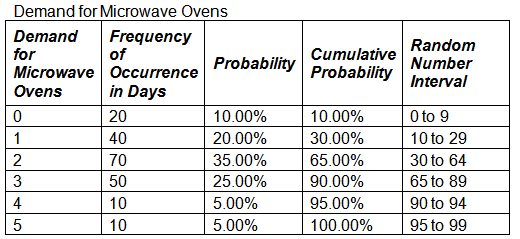

Consider the Demand for Microwave Ovens dataset. What is the total demand corresponding to random numbers 86, 47, 38, 81, 47, and 45?

a. 15

b. 14

c. 13

d. 12

Ronnie is the owner of a pet store and manages the store by himself. Any profit that Ronnie's store earns is:

A. used to purchase preferred stocks of the store. B. treated as Ronnie's personal income. C. not subjected to any form of taxation. D. taxed only if Ronnie has taken a loan.