When the money market is drawn with the value of money on the vertical axis, if the Federal Reserve sells bonds, then the money supply curve

a. shifts right, causing the price level to rise.

b. shifts right, causing the price level to fall.

c. shifts left, causing the price level to rise.

d. shifts left, causing the price level to fall.

d

You might also like to view...

In a recession, consumers have less income to spend. As a result, if dining out is a normal good, then which of the following would happen to the demand curve for dining out?

A) The demand curve would shift leftward. B) The demand curve would not shift but the price of dining out would rise. C) The effect on the demand curve is unknown. D) The demand curve would shift rightward. E) The demand curve would not shift but the price of dining out would fall.

The value of Russia's petroleum exports rises predictably when it is cold in Europe and declines during the warmer months. Is the spot exchange rate (euro/RUB) likely to match this pattern?

What will be an ideal response?

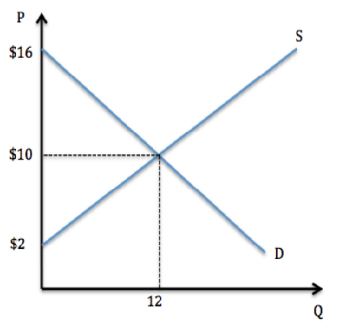

According to the graph shown, consumer surplus is:

A. the area under the supply curve and above the price.

B. the area above the supply curve and below the price.

C. the area under the demand curve and above the market price.

D. the area above the demand curve and below the price.

The reason that the Fed does not actively use discount rate policy to control the money supply is because the Fed

a. acts when a majority of member banks agree on policy and the banks rarely agree. b. earns interest on discounting and cannot afford to lose the revenue. c. does not know how banks will respond to discount rate changes. d. has been directed by Congress to set the discount rate at a permanent level.