According to the Taylor rule, when real GDP is at its potential and inflation is at its target rate of 2 percent, the Fed should:

A. carefully lower the federal funds rate in an attempt to stimulate noninflationary real GDP

growth.

B. raise the federal funds rate in an attempt to eliminate the remaining inflation.

C. lower the federal funds rate to lower borrowing costs for the federal government.

D. keep the federal funds rate at 4 percent.

D. keep the federal funds rate at 4 percent.

You might also like to view...

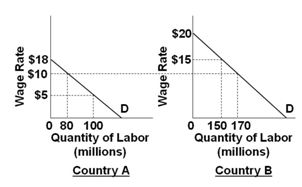

Refer to the below graphs. (Assume that the pre-migration labor force in Country A is 100 and that it is 150 in country B.) What part of domestic output in country B is the total wage bill before and after the immigration?

A. $1,700M before and $2,250M after

B. $2,250M before and $1,700M after

C. $1,500M before and $2,250M after

D. $1,700M before and $1,500M after

In the above figure, when real disposable income is less than 600, then

A) consumption is less than disposable income. B) consumption is the same as disposable income. C) consumption is more than disposable income. D) the MPC will fall.

Governments sometimes erect barriers to trade other than tariffs and quotas. Which of the following is not an example of this type of trade barrier?

A) a requirement that the U.S. government buy military uniforms only from U.S. manufacturers B) a requirement that imports meet health and safety requirements C) restrictions on imports for national security reasons D) a requirement that the employees of domestic firms that engage in foreign trade pay income taxes

When the firm produces zero output, its variable cost is

a. zero b. the same as total cost c. the same as fixed costs d. the same as price e. infinite