A young working couple earned $50,000 last year. Of that, they paid $16,000 in taxes and $15,000 in rent, food, insurance and other necessities. Their discretionary income for the year was

A. $50,000.

B. $34,000.

C. $15,000.

D. $35,000.

E. $19,000.

Answer: E

You might also like to view...

Computer-assisted questionnaire design is easy, fast, friendly, and flexible

Indicate whether the statement is true or false

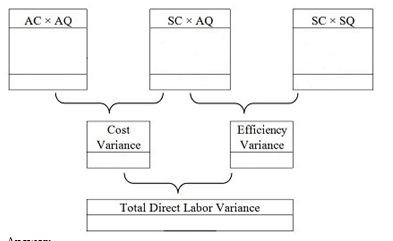

Golden Glow Company manufactures candles. The standard direct materials quantity required to produce one large candle is 1 pound at a cost of $5 per pound. Every candle requires 2 direct labor hours at a standard cost of $3 per direct labor hour. During November, 7,200 large candles were produced using 7,500 pounds costing $45,000. At the end of November, an examination of the labor cost records showed that the company used 15,000 direct labor hours (DLHr) at a cost of $4 per hour.

Using the format below, prepare an analysis of the direct labor cost variances.

The marketing mix refers to the set of marketing tools the firm uses to implement its marketing strategy

Indicate whether the statement is true or false

List and briefly explain the functions of a negotiable instrument

What will be an ideal response?