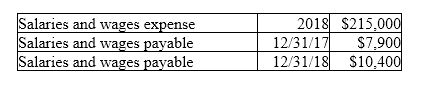

From the Income Statement and Balance Sheet information listed below, what amount of cash was paid for salaries and wages during 2018?

A) $212,500

B) $217,500

C) $215,000

D) $233,300

A) $212,500

Explanation: salary expense - increase in payable = cash paid; ex: $215,000 - ($10,400 - $7,900)

= $212,500

You might also like to view...

What are the basic stages of the data warehousing process?

Which of the following is NOT a potential problem when estimating and using betas, i.e., which statement is FALSE?

A. Sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different from the "true" or "expected future" beta. B. The beta of an "average stock," or "the market," can change over time, sometimes drastically. C. Sometimes the past data used to calculate beta do not reflect the likely risk of the firm for the future because conditions have changed. D. All of the statements above are true. E. The fact that a security or project may not have a past history that can be used as the basis for calculating beta.

Haverhill Products completed Job 440 and several other jobs during the year

In addition to direct labor and direct materials cost, Haverhill allocated $450 of manufacturing overhead to the job. Provide the journal entry for the allocation of manufacturing overhead. What will be an ideal response

A sales tax is an example of an activity-based tax.

Answer the following statement true (T) or false (F)