Sharon pays a tax of $4,000 on her income of $40,000 . while Brad pays a tax of $1,000 on his income of $20,000 . This tax is:

a. regressive.

b. progressive.

c. proportional.

d. a flat tax.

b

You might also like to view...

Which of the following is NOT an asset of the Federal Reserve System?

A) mortgage-backed securities B) reserves of depository institutions C) U.S. government securities D) None of the above are correct because they are all assets of the Federal Reserve.

If the revenues from a Pigovian tax are not directed to those who are affected by the externality, the outcome:

A. is efficient and maximizes surplus. B. is not efficient and does not maximize surplus. C. is efficient, but does not maximize surplus. D. is not efficient and maximizes surplus.

Which of the following examples involves variable costs

a. Last year, Gerard Industries paid $2 million for raw materials. b. Gerard Industries pays $100,000 a year for rent. c. Gerard Industry just made an annual insurance payment of $50,000. d. The property tax rate for Gerard Industries remains at 2 percent.

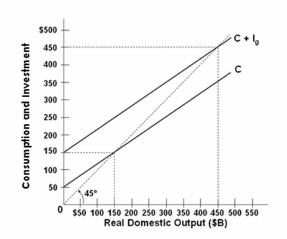

Refer to the graph above for a private closed economy. At the equilibrium level of GDP, saving will be:

A. $50 billion

B. $100 billion

C. $150 billion

D. Cannot be determined from the information given