How did asset backed commercial paper (ABCP) rollover risk contribute to the financial crisis of 2007-2009?

What will be an ideal response?

ABCP creates a mismatch between the long-term maturity of the asset (mortgage) and the short-term maturity of the liability (ABCP). When the ABCP matures the issuers may have to borrow to meet their payment obligations which creates rollover risk because of the possibility that the market for borrowing may have dried up. This is exactly what happened in the early days of the financial crisis of 2007-2009.

You might also like to view...

Vaccination against a disease helps in preventing the spread of the disease. Which of the following can help in increasing the number of people vaccinated to the socially optimal level?

A) A corrective tax B) An income tax C) A life insurance D) A health tax

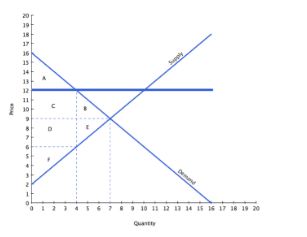

Which of the following changes to the market in the graph shown could cause the price floor to become non-binding?

A. Demand could decrease, and shift to the left.

B. Supply could increase, and shift to the left.

C. Supply could increase, and shift to the right.

D. Supply could decrease, and shift to the left.

In perfect competition as well as in monopolistic competition,

a. marginal revenue is equal to price for each firm. b. profit is positive in a long-run equilibrium for each firm. c. entry and exit by firms are restricted. d. there are many firms in a single market.

The period starting around 200 years ago is important in economic history because this is approximately the time when

a. economies started to decline, resulting in lower standards of living. b. money was invented. c. economic growth began in some countries, resulting in sustained improvements in the standard of living. d. the world caught up to the standard of living of ancient Rome.