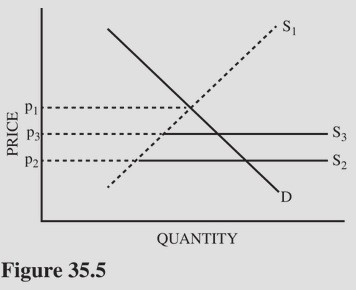

Refer to Figure 35.5. S1 represents the U.S. domestic supply of a good and S2 represents supply in the United States under conditions of free trade. If the United States imposes a tariff on this good, what will happen to the quantity imported?

Refer to Figure 35.5. S1 represents the U.S. domestic supply of a good and S2 represents supply in the United States under conditions of free trade. If the United States imposes a tariff on this good, what will happen to the quantity imported?

A. Imports will increase as price increases and domestic production increases.

B. Imports will decline as price increases and domestic production decreases.

C. Imports will decline as price increases and domestic production increases.

D. Imports will increase because producers will pass the cost of the tariff on to consumers.

Answer: C

You might also like to view...

Use the following table to answer the next question.YearAltaZornAltaZorn?(Real GDP)(Real GDP)(Population)(Population)1$2,000$150,00020050022,100152,00020250532,200154,000210508Per capita GDP was about

A. $303 in year 3 in Zorn. B. $5 in year 2 in Alta. C. $105 in year 3 in Alta. D. $200 in year 1 in Zorn.

When the supply of a good is represented by a horizontal line, the burden of a tax is: a. shared equally between the buyers and the sellers. b. placed entirely on the buyers

c. placed entirely on the sellers. d. more on the buyers than on the sellers.

The demand curve for a factor is that part of the MRP where marginal product is

A. rising. B. falling. C. positive. D. negative.

Which of the following could not be expected to shift the aggregate demand curve?

A. net exports fall B. consumption spending decreases C. an increase in government spending D. a change in real GDP