The surplus that is lost and not converted to tax revenue when a tax is imposed is:

A. deadweight loss.

B. value that disappears.

C. not transferred to anyone else.

D. All of these statements are true.

D. All of these statements are true.

You might also like to view...

A corporation is considered a multinational ________ if ________

A) parent; it owns more than 10% of a foreign firm B) parent; more than 10% of its stock is held by a foreign company C) child; more than 10% of its stock is held by a foreign company D) child; more than 50% of its stock is held by a foreign company E) monopolist; it owns more than 50% of a foreign firm

Which of the following does NOT describe the relationship between banks and small business during the 2000s (prior to the financial crisis)?

A) Banks typically applied fixed guidelines for granting loans, leaving little room for personal judgment. B) Fewer small businesses received loans as banks shifted their focus to mortgages. C) Many small businesses were receiving loans from regional and national banks. D) More banks became convinced that it would be profitable to loosen their loan guidelines to make more borrowers eligible to receive credit.

Premiums based on experience ratings

a. are uniform across age groups. b. are based on the loss experience of the insured. c. vary depending on the income of the insured. d. are illegal in most states in the U.S. e. are only used in property-casualty insurance underwriting.

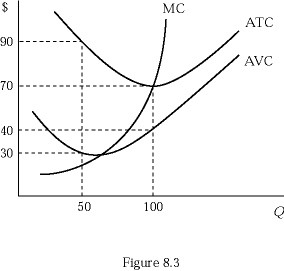

Figure 8.3 shows a firm's marginal cost, average total cost, and average variable cost curves. The firm's total fixed cost is:

Figure 8.3 shows a firm's marginal cost, average total cost, and average variable cost curves. The firm's total fixed cost is:

A. $2,800. B. $3,000. C. $4,500. D. $7,000.