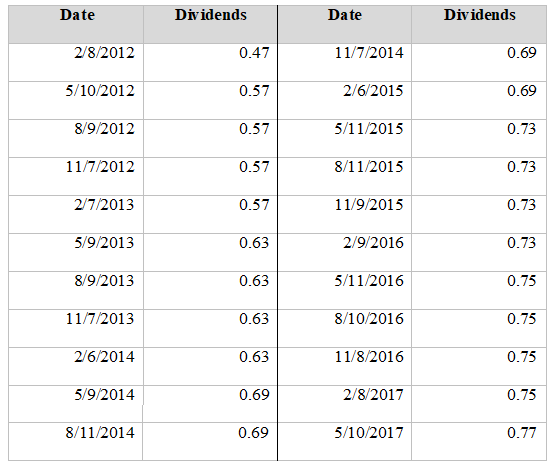

The following table contains the five-year dividend history for Exxon Mobil Corporation.

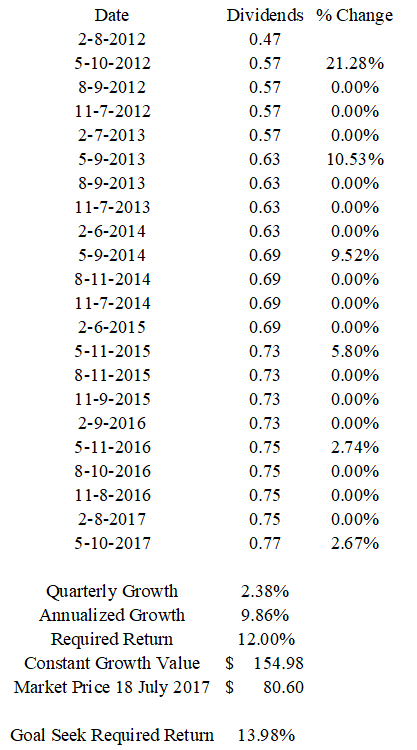

a) Calculate the quarterly percentage change in the dividends, and the compound quarterly growth rate of the dividends using the GEOMEAN function.

b) Annualize the quarterly dividend growth rate and calculate the intrinsic value of the stock using a 12% required rate of return and the calculated annual growth rate. Use the sum of the most recent four dividends as D0. How does the calculated intrinsic value compare to the historical price of the stock of $80.60 on 7/18/2017?

c) Use the Goal Seek option to find the implicit required rate of return setting the price to $80.60 (the price of Exxon Mobil on 7/18/2017) by changing the required rate of return.

You might also like to view...

Flankers are brands that may be kept around despite dwindling sales because they manage to maintain their profitability with virtually no marketing support

Indicate whether the statement is true or false

Exhibit 15-5 On January 1, 2016, Roberts Company adopts a compensatory share option plan and grants 40 executives 1,000 shares each at $30 a share. The fair value per option is $7 on the grant date. The company estimates that its annual employee turnover rate during the service period of three years will be 4%. ? Refer to Exhibit 15-5. At the end of 2017, the company estimates that the employee

turnover will be 5% a year for the entire service period. The compensation expense for 2017 will be (Round your answer to the nearest whole dollar.) A) $77,468 B) $80,022 C) $82,575 D) $160,043

One reason people are motivated to manage impressions is ______.

A. the relevance of the goal of the impressions B. their interest in sticking with their current image C. peer pressure D. impression management

Sunshine Corp. announces a 2-for-1 stock split for its shares trading at $100. If the current number of shares outstanding is 200,000, then the new market price of the share will be _____.

A. ?$100 B. ?$300 C. ?$50 D. ?$20 E. ?$70