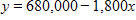

A $680,000 property is depreciated for tax purposes by its owner with the straight-line depreciation method. The value of the building y, after x months of use is given by  dollars. After how many months will the value of the building be $377,000? Round your answer to the nearest whole number of months.

dollars. After how many months will the value of the building be $377,000? Round your answer to the nearest whole number of months.

?

A. 587 months

B. 378 months

C. 168 months

D. 209 months

E. 419 months

Answer: C

Mathematics

You might also like to view...

Solve the equation. -

-  =

=

A. ? B. {7} C. {-1} D. {1}

Mathematics

Solve.In preparation for his new job, Tristan bought two suits at $184 a piece, four shirts at $27 a piece, two pairs of shoes at $73 a piece, four ties at $27 a piece, and five pairs of socks at $6 a piece. What was the total cost of these items?

A. $760 B. $781 C. $730 D. $317

Mathematics

Writing the system of equations as a matrix equation solve the system of equations by using the inverse of the coefficient matrix

Mathematics

Solve and check. Use the square root principle to eliminate the square.(r + 4)2 = 10

A. 4 ±

B. -4 ±

C. ±

D. 6

Mathematics