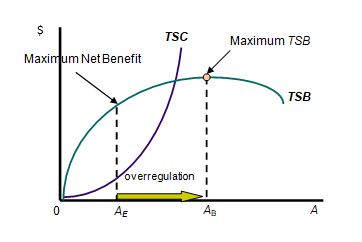

Repeat the exercise using total analysis (i.e., total social benefits (TSB) and total social costs (TSC)).

What will be an ideal response?

Using total analysis (TSB, TSC), the risk-based abatement level arises where TSB is at its maximum, at AB, with no consideration for TSC. Notice that ABis above the efficient abatement level, AE, which represents a maximization of net benefits, accounting for both TSB and TSC. This model illustrates that risk-based abatement of Superfund sites leads to overregulation.

You might also like to view...

The precautionary demand for holding money arises because

A) people want be able to make unexpected purchases or to meet emergencies. B) credit cards charge low interest rates, which makes money more attractive than credit. C) expected transactions are completed more easily with debit cards than with credit cards. D) people would rather hold money in the form of time deposits than in the form of hard currency.

An economy is an organization that produces goods and services and then allocates those goods and services to its members

Indicate whether the statement is true or false

If inflation falls,

a. people choose to put in more effort to keep money balances low. When inflation is unexpectedly low it redistributes wealth from lenders to borrowers. b. people choose to put in more effort to keep money balances low. When inflation is unexpectedly low it redistributes wealth from borrowers to lenders. c. people choose to put in less effort to keep money balances low. When inflation is unexpectedly low it redistributes wealth from lenders to borrowers. d. people choose to put in less effort to keep money balances low. When inflation is unexpectedly low it redistributes wealth from borrowers to lenders.

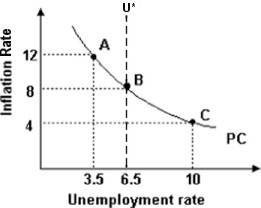

Refer to the above figure. Suppose the economy is at point B and the central bank adopts contractionary monetary policy. In the short run, this will result in

Refer to the above figure. Suppose the economy is at point B and the central bank adopts contractionary monetary policy. In the short run, this will result in

A. the economy moving towards point A. B. the economy staying at point B. C. the economy moving towards point C. D. an outcome that cannot be predicted, because not enough information is given.