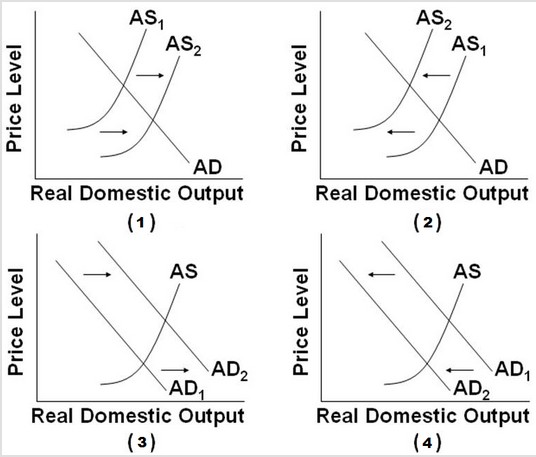

Use the following diagrams for the U.S. economy to answer the next question. Assuming the economy is initially at full employment, which of the diagrams best portrays a recession?

Assuming the economy is initially at full employment, which of the diagrams best portrays a recession?

A. Graphs (1) and (2)

B. Graphs (1) and (3)

C. Graphs (2) and (4)

D. Graphs (3) and (4)

Answer: C

You might also like to view...

On a typical acre of land, Iowa can produce either 300 pounds of beef or 100 pounds of soybeans in a year. On a typical acre of land, Nebraska can produce 150 pounds of beef or 200 pounds of soybeans. Which of the following is correct?

A) Nebraska should produce soybeans because its opportunity cost of soybeans is lower. B) Nebraska should produce soybeans because its opportunity cost of soybeans is higher. C) Iowa should produce soybeans because its opportunity cost of soybeans is lower. D) Iowa should produce soybeans because its opportunity cost of soybeans is higher. E) Nebraska and Iowa should divide each acre evenly between soybean and beef production.

A critical assumption for the simple money multiplier (1/ rrd) to hold is that

a. banks do not hold excess reserves. b. the public does not increase their level of currency holdings. c. the required reserve ratio has to be greater than one. d. both a and b. e. all of the above.

Define rent seeking. Is rent-seeking activity likely to be highly profitable in the long run? Why or why not?

What will be an ideal response?

Which of the following is a difference between an active approach to close a recessionary gap and a passive approach to close a recessionary gap?

a. The level of real GDP would be higher in the long run with the active approach, while it will be lower with the passive approach. b. The level of real GDP would be lower in the long run with the active approach, while it will be higher with the passive approach. c. The price level would be higher and the level of real GDP would be lower in the long run with the active approach, whereas the price level would be lower and real GDP level would be higher with the passive approach. d. Only the price level would be lower in the long run with the active approach, whereas it would be higher with the passive approach. e. Only the price level would be higher in the long run with the active approach, whereas it would be lower with the passive approach.