For an imaginary economy, when the real interest rate is 5 percent, the quantity of loanable funds demanded is $100,000 and the quantity of loanable funds supplied is $100,000 . Currently, the nominal interest rate is 6 percent and the inflation rate is 2 percent. Currently,

a. the market for loanable funds is in equilibrium.

b. the quantity of loanable funds supplied exceeds the quantity of loanable funds demanded, and as a result the real interest rate will rise.

c. the quantity of loanable funds supplied exceeds the quantity of loanable funds demanded, and as a result the real interest rate will fall.

d. the quantity of loanable funds demanded exceeds the quantity of loanable funds supplied, and as a result the real interest rate will rise.

d

You might also like to view...

Winnie's Car Wash is a perfectly competitive firm. The table above shows Winnie's total product schedule. If the price of a car wash is $5 and the wage rate is $62.50 per day, how many workers should Winnie employ to maximize his profit?

A) 2 B) 3 C) 4 D) 5

The research of Gavin Wright (1978) on the antebellum period suggests that

(a) there was no limit on the profitability of the plantation utilizing slave labor. (b) issues with management, communication and discipline limited the profitability of the slave plantation. (c) more than 75 percent of the Southern farms were plantations and utilized slave labor. (d) all of the above.

Suppose that personal income is $250 billion. Furthermore, assume that retained corporate earnings are $2 billion, social security taxes are $15 billion, social security benefit checks equal $16 billion, the capital consumption allowance is $32 billion, and corporate taxes amount to $40 billion. What will be the value of net national product in this country?

a. $209 billion b. $219 billion c. $283 billion d. $291 billion e. $323 billion

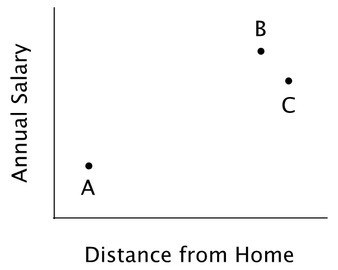

Natasha is having difficulty deciding between two jobs, A and B. As shown in the accompanying diagram, A is closer to home than B, but doesn't pay as well. Ideally, Natasha would like a job that both pays well and is close to her home. If Natasha behaves like most decision-makers, then the addition of option C would:

If Natasha behaves like most decision-makers, then the addition of option C would:

A. decrease her likelihood of accepting any job. B. increase her likelihood of picking B. C. increase her likelihood of picking A. D. have no impact on her choice of A and B.