Riva works at a full-time job, but also restores her antique doll collection and sells them on eBay. She received $10,000 of sales revenue and paid $12,000 of supplies expense. A number of factors must be weighed to determine the appropriate classification of the activity. Depending on that classification, the net effect on her taxable income will be

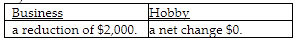

A)

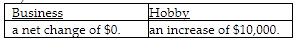

B)

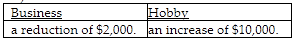

C)

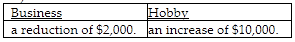

D)

D)

If an activity qualifies as a business, the taxpayer generally may deduct all qualified business expenses from gross income. If an activity is classified as a hobby, the revenue must be include in gross income, but no deductions are allowed.

You might also like to view...

Another name for commodity money is

A. fiat money. B. glitter money. C. full-bodied money. D. inside money.

When creating value, the goal is to push possible solutions to the Pareto efficient frontier. Describe the ideal point that lies on this "frontier" line.

What will be an ideal response?

Azul Incorporated has 3,500,000 shares of common stock outstanding on December 31 . 2013 . An additional 400,000 shares of common stock were issued April 1 . 2014, and 150,000 more on July 1 . 2014 . On October 1 . 2014, Azul issued 5,000, $1,000 face value, 7 percent convertible bonds. Each bond is convertible into 40 shares of common stock. No bonds were converted into common stock in 2014

What is the number of shares to be used in computing basic earnings per share and diluted earnings per share, respectively? a. 3,725,000 and 3,750,000 b. 3,725,000 and 3,900,000 c. 3,875,000 and 3,925,000 d. 3,875,000 and 4,125,000

After the copyright period runs out, the work enters the public domain

Indicate whether the statement is true or false