LED Corp.'s common stock paid $2.50 in dividends last year (D0 )

Dividends are expected to grow

at a 12-percent annual rate forever. If LED's current market price is $40.00, and your required rate

of return is 23 percent, should you purchase the stock?

A) Yes, the stock is expected to return more than you require.

B) No, the percentage return on the stock is too high, thus it is too risky.

C) No, the stock is overpriced.

D) Not enough information is given.

C

You might also like to view...

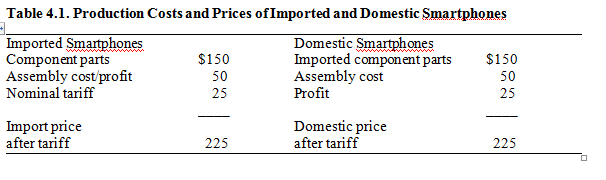

Consider Table 4.1. Prior to the tariff, the total price of domestically produced smartphones is

a. $150.

b. $200.

c. $225.

d. $250.

Which of the following guidelines about overcoming intercultural barriers is NOT appropriate?

a. One should study and learn about a person's culture. b. The person should seek help from a trusted friend who understands the other person's culture. c. One should be patient and tolerant of ambiguity. d. One should help the other person overcome his or her cultural barriers by conforming to the new culture.

The Federal Drug-Free Workplace Act mandates drug testing for employers receiving federal:

a. social security benefits. b. health care policy. c. funding. d. government job.

At Gashakry, a tools manufacturing company, the candidates who apply for factory jobs are tested for their knowledge in computer numerical control machinery through a series of questions. In the context of employee selection, this scenario most likely illustrates _____.

A. exit interviews B. open-ended interviews C. appraisal interviews D. structured interviews