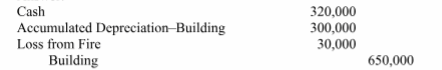

Wallace Company had a building that was destroyed by fire. The building originally cost $650,000, and its accumulated depreciation as of the date of the fire was $300,000. The company received $320,000 cash from an insurance policy that covered the building and will use 128 Copyright ©2018 McGraw-Hill that money to help rebuild. Prepare the single journal entry to record the disposal of the building and the receipt of cash from the insurance company.

What will be an ideal response?

You might also like to view...

A nation's banking system, health care system, transportation system, and communications system, as well as the availability and cost of using these systems are considered as ________ resources available for competitive advantage of a business

A) knowledge B) physical C) human D) infrastructure E) capital

Clearwater Hampers is a small British company that sells luxury food and drink in various combinations in picnic hampers. Food and wine are seen as classic, fail-safe gifts in a market where present-buying is increasingly tricky. Corporate customers, both in the United Kingdom and abroad, are important to the business. Clearwater has had several orders for more than a quarter of a million dollars. The company's leading salesperson, Peter Austin, is preparing the approach he will use during his first sales call with the CEO of Diamonite, a company that specializes in designing, manufacturing, and installing aircraft interiors for executives and heads of state."Hi, I'm Peter Austin from Clearwater Hampers. How would you like to give your clients a unique gift that will clearly demonstrate

your gratitude for their business?" Austin's question suggests that he is using the ________ approach. A. premium B. customer benefit C. FAB D. interrogatory E. showmanship

In the first few decades of the 20th century, leadership definitions centered on the notion of ______.

A. relationships B. process C. domination D. personality

Unlimited liability refers to

A) a claim to the partners' personal assets by creditors if the partnership cannot pay its debts. B) the ability of any partner to bind the partnership to a business agreement as long as he or she acts within the scope of the company's normal operations. C) co-ownership of partnership property. D) the method of income distribution.