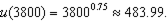

Suppose you rent an apartment and are worried about a break-in that results in theft of your property. Suppose your monthly consumption level is currently $4,000 but a break-in would result in you having to finance your purchase of replacement property -- and this would reduce your current consumption to $2,000 per month. There is a 10% chance of a break-in, and your tastes can be modeled with the expected utility form using the function  .

.

a. What is the utility of the expected value of the gamble you face, and what is the expected utility of the gamble?

b. How does your answer to (a) change if the probability of a break-in increases to 20%?

c. What is the certainty equivalent and the risk premium in each case?

d. What equation would you have to solve to get the answer to the following: How much would you be willing to pay to keep the crime rate in your area from increasing (i.e. to keep the probability of a break in to 10% rather than have it rise to 20%) assuming there is no rental insurance available in your area?

e. What would you be willing to pay to avoid the increase in the crime rate if there is a full menu of actuarily fair rental insurance available at all times?

What will be an ideal response?

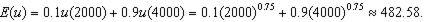

The expected utility is

The expected utility is

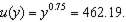

b. The utility of the expected value goes to approximately 464.76 while the expected utility goes to approximately 462.19.

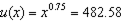

c. The certainty equivalent initially is the amount x such that

and then becomes the amount y such that

and then becomes the amount y such that  Solving for x and y, we get an initial certainty equivalent of $3,785.26 falling to $3,573.53.

Solving for x and y, we get an initial certainty equivalent of $3,785.26 falling to $3,573.53.The risk premium is simply the expected value of the gamble minus the certainty equivalent, which implies that the risk premium increases from $14.74 to $26.47.

d. The most you would be willing to pay to keep the crime rate from increasing is an amount that leaves your expected utility at the lower crime rate (after making your payment) equal to your expected utility (without making a payment) at the higher crime rate; i.e. you would be willing to pay an amount x such that

e. Under actuarily fair insurance, you can always get the utility of the expected value of the gamble. If the crime rate increases, the expected value of the gamble is $3,600, whereas it is $3,800 if it does not increase. You would therefore be willing to pay up to $200 to avoid the increase in crime.

You might also like to view...

The practice of tying can make entry difficult

Indicate whether the statement is true or false

Refer to Figure 9.9. Now suppose an import quota of 3000 trucks is imposed. The quota will make total domestic producer surplus equal to

A) $2,500. B) $5,000. C) $5,000,000. D) $10,000,000. E) $30,000,000.

A tax on buyers usually causes buyers to pay more for the good and sellers to receive less for the good than they did before the tax was levied

a. True b. False Indicate whether the statement is true or false

The distinction between saving and savings is that saving is ________, while savings is ________.

A. the flow of funds that is not consumed out of income; the plural of saving B. the flow of funds that someone invests in bank savings accounts; the stock of funds that represents the accumulated amount of net saving over time C. the flow of funds that is not consumed out of income; the stock of funds that is invested in bank savings accounts D. the flow of funds that is not consumed out of income; the stock of funds that represents the accumulated amount of net saving over time