Advocates of a progressive income tax use arguments EXCEPT for which of the following?

A) A progressive tax system taxes according to ability to pay.

B) A progressive tax system taxes according to benefits received.

C) A progressive tax system helps redistribute income away from the rich and towards the poor.

D) A progressive tax system maximizes government revenues.

Answer: B

You might also like to view...

The market system provides a way

A. to allow specialization and exchange to work in tandem. B. to improve the well-being of mankind. C. to harness self-interest. D. to allocate goods and services. E. All of the responses are correct.

Which of the following is not an example of a noncooperative oligopoly model?

A) The kinked demand curve model. B) The model of limit pricing. C) The prisoner's dilemma game. D) The cartel model.

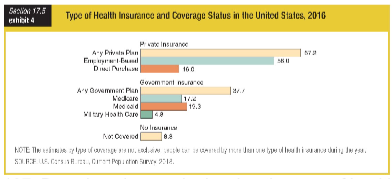

Based on the graph showing the type of health insurance and coverage status in the United States in 2016, the smallest percentage of people are covered by ______ plans.

a. direct purchase

b. military health care

c. Medicare

d. employment-based

The multiple linear regression model with a binary dependent variable is called the linear probability model.

Answer the following statement true (T) or false (F)