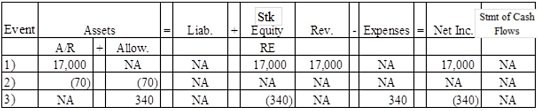

Pena Company experienced the following events during Year 1:1)Recognized $17,000 of service revenue on account2)Wrote off as uncollectible an account receivable, $70.3)Prepared the adjusting entry to recognize uncollectible accounts expense. Pena expected that 2% of service revenue would not be collectedRequired: Show how each of these events would affect the elements of the financial statements using the table shown below. Include dollar amounts of increases and decreases. When an account is not affected by a particular event, indicate with NA.

What will be an ideal response?

When a company uses the allowance method, it may begin writing off uncollectible accounts (event 2) even before the first estimate has been made to increase the allowance account (event 3). No expense is recognized when an account is written off. Instead, the expense is recognized when the adjusting entry is made to recognize the estimate of uncollectible accounts.

You might also like to view...

An example of an unearned revenue account would include

a. Prepaid Interest; b. Unearned Maintenance Revenue; c. Subscription Revenue; d. Prepaid Insurance; e. Supplies.

List the three key benefits companies get from preparing a budget.

What will be an ideal response?

Which of the following is not a way to accurately determine the financial performance of a company?

A) carefully examining one year's data B) from year to year C) with a competing company D) with the same industry as a whole

Most of the customers in any business are buyers in the ordinary course of business

Indicate whether the statement is true or false