Assume an electric company has spent $3 billion on a nuclear power plant. It's producing at a price per kilowatt hour that is above its average variable cost. However, after 10 years the price remains below average total cost

If there is no expectation that price will equal or rise above the average total cost what would you expect this company to do with its nuclear power plant? Why is the $3 billion not part of the decision? Explain.

In the short run it is acceptable to make an operating profit in order to minimize economic losses. However, in the long run the expectation is that the firm should be able to enjoy at least a normal profit. Since this firm has no hope of earning a normal profit the best thing to do in the long run is to shut down the nuclear power plant.

You might also like to view...

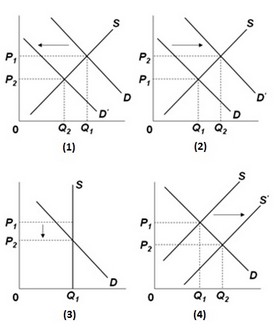

Use the figure below to answer the following question.  For which graph is the supply perfectly inelastic?

For which graph is the supply perfectly inelastic?

A. graph 1 B. graph 2 C. graph 3 D. graph 4

The above figure shows the competitive market for turkey. The consumer surplus for the 300 millionth pound of turkey is

A) $2.00 per pound. B) $225 million. C) $0.80 per pound. D) $0.50 per pound.

Banks can make additional loans when required reserves are

A) less than total deposits. B) greater than total reserves. C) less than total reserves. D) less than total loans.

Fluctuations in Tobin's q are ________, because ________

A) frequent and substantial; asset prices are volatile B) frequent and substantial; replacement costs are volatile C) infrequent and mild; replacement costs are relatively stable D) infrequent and mild; the marginal product of capital does not change quickly