Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions: Cost of Goods Sold$85,000Cash Distribution to Harry$15,000Municipal Bond Interest$1,500Short-Term Capital Gains$4,500Employee Wages$40,000Rent$10,000Charitable Contributions$25,000Sales$175,000Repairs and Maintenance$5,000Long-Term Capital Gains$12,000Fines and Penalties$5,000Guaranteed Payment to Lloyd$25,000 Given these items, what amount of ordinary business income (loss) and what separately stated items should be allocated to each partner for the year?

What will be an ideal response?

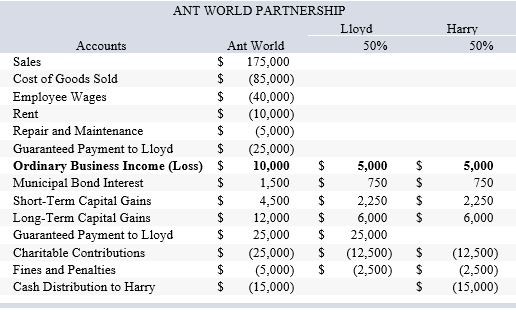

The amount of ordinary business income (loss) and the separately stated items allocated to Lloyd and Harry are shown in the table below:

You might also like to view...

According to the revenue recognition principle, revenues are recognized when they are _________________________

Fill in the blank(s) with correct word

JIT concepts

a. can be effectively implemented in organizations that are only partially automated. b. are only appropriate for use with CIM systems. c. involve shifting from a capital-intensive to a labor-intensive process. d. require full computerization of the JIT manufacturing process.

Neutral messages contain content that is not likely to generate an emotional message from the receiver

Indicate whether the statement is true or false

Which of the following is not a social networking site?

A) LinkedIn B) Facebook C) Twitter D) Firefox