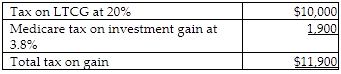

Jade is a single taxpayer in the top tax bracket, with salary of $500,000 and investment income of $100,000. She is considering the sale of some shares of stock which will result in a $50,000 gain. She purchased the shares three years ago. Taking all taxes into account, how much tax will she pay due to this gain?

What will be an ideal response?

You might also like to view...

Creativity is defined as:

a. something that is both novel and useful. b. a process that uses divergent thinking. c. a process that uses convergent thinking. d. all of the above are true.

Choose the correct verb in parentheses. We never needed to call a repair service; my father (might, could) fix anything

For which of the following service providers would a guarantee be inappropriate?

A. An engine tune-up at a car dealership B. A travel agency C. A university D. A truck rental company E. A child care provider who has a reputation for providing the best and most responsible child care in a community

Lossing Corporation applies manufacturing overhead to products on the basis of standard machine-hours. Budgeted and actual overhead costs for the most recent month appear below: Original BudgetActual CostsVariable overhead costs: Supplies$11,220 $10,670 Indirect labor 8,670 8,030 Fixed overhead costs: Supervision 5,610 5,940 Utilities 8,160 7,990 Factory depreciation 39,780 39,950 Total overhead cost$73,440 $72,580 ?The company based its original budget on 5,100 machine-hours. The company actually worked 4,800 machine-hours during the month. The standard hours allowed for the actual output of the month totaled 4,980 machine-hours. What was the overall fixed manufacturing overhead volume variance for the month?

A. $1,260 Favorable B. $3,150 Favorable C. $3,150 Unfavorable D. $1,260 Unfavorable