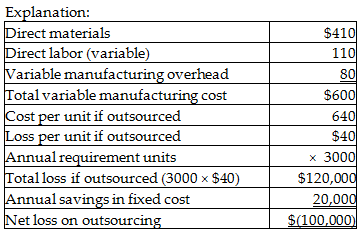

A supplier has offered to sell the component to Carver for $640 per unit. If Carver buys the component from the supplier, the released facilities can be used to manufacture a product that would generate a contribution margin of $20,000 annually. Assuming that Carver needs 3000 components annually and that the fixed manufacturing overhead is unavoidable, what would be the impact on operating income if Carver outsources?

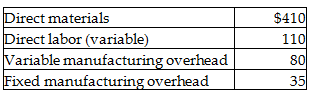

Carver Company manufactures a component used in the production of one of its main products. The following cost information is available:

A) Operating income would decrease by $100,000.

B) Operating income would increase by $20,000.

C) Operating income would decrease by $20,000.

D) Operating income would increase by $120,000.

A) Operating income would decrease by $100,000.

You might also like to view...

"The training session was worthwhile; it was worthwhile because employees learned to do the task correctly," is an example of the emphasis technique of _____.?

A) ?position B) ?repetition C) ?words that label D) ?space and format

The landlord ran the model in Excel and received the answer report contained in the table. Which of the following statements is correct?

Variable Cells Cell Name Original Value Final Value $G$4 wood floors contractor 1 0 $H$4 wood floors self 1 1 $G$5 kitchen tile contractor 1 1 $H$5 kitchen tile self 1 0 $G$6 back door contractor 1 0 $H$6 back door self 1 0 $G$7 garage door opener contractor 1 0 $H$7 garage door opener self 1 0 A) The rent will be $180 higher and the project will take 3.5 weeks to finish at a cost of $2900. B) The rent will be $195 higher and the project will take 2.5 weeks to finish at a cost of $2900. C) The rent will be $180 higher and the project will take 2.5 weeks to finish at a cost of $3700. D) The rent will be $195 higher and the project will take 3.5 weeks to finish at a cost of $3700.

__________ jurisdiction refers to the authority of a particular court to judge a controversy of a particular kind

a. Exclusive federal b. Subject matter c. Concurrent federal d. None of these

Corporations pay their own income tax on corporate income. Stockholders pay personal income tax on the dividends received from corporations. This is an example of ________

A) double taxation B) continuous life C) no mutual agency D) a limited liability company