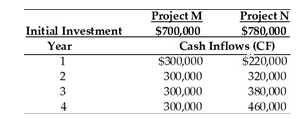

Using the risk-adjusted discount rate method of project evaluation, the NPV for Project N is ________.

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below. Tangshan Mining's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

A) $166,132

B) $122,970

C) $85,732

D) $600,000

C) $85,732

You might also like to view...

In the antitrust area, the U.S. is concerned with the impact of the business deal on the consumer, whereas the EU is focused on the competitive structure of the marketplace, and so pays attention to its rivals.

Answer the following statement true (T) or false (F)

Which of the following is an action the Federal Trade Commission (FTC) can take to stop a company from continuing an unfair trade practice?

A. corrective advertising B. a private ruling C. a cease and desist order D. a consent degree E. a stay

. What is included in the Financial Plan section of a business plan?

a. the industry, structure, products, services b. a description of potential customers and competitors c. income and cash flow, balance sheets, and financial projections d. financial projections only

Declaring and paying dividends causes an increase in both assets and stockholders' equity of the corporation

Indicate whether the statement is true or false