Serfass Corporation's contribution format income statement for July appears below: Sales$260,000Variable expenses 176,000Contribution margin 84,000Fixed expenses 71,800Net operating income$12,200The degree of operating leverage is closest to:

A. 0.05

B. 0.15

C. 6.89

D. 21.31

Answer: C

You might also like to view...

You change the oil in your car yourself and dump the used oil down the sewer drain that ultimately flows into the local river. Oil manufacturers know this is not an isolated occurrence, so should they be concerned?

A. Yes, this is the type of situation that can get "Big Oil" a lot of bad press. B. No, the oil company will someday add a premium to the price to pay for oil cleanup in the environment. C. Yes, this is an issue of social responsibility because the polluted water affects others in the society at large. D. No, this is an issue solely between you and your neighbors. E. No, you paid for the oil and you can dispose of it as you like.

In a contract where there is no agreement between two parties for delivery in installments, all the goods ________.

A. must be delivered in reasonably spaced intervals B. must be delivered to the buyer in a single delivery C. must be delivered at the seller's discretion D. must be delivered in the installments at the seller's discretion

Nonprofit corporations are exempt from involuntary bankruptcy proceedings

Indicate whether the statement is true or false

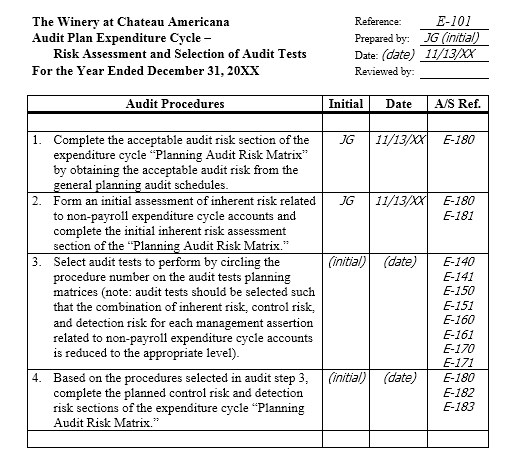

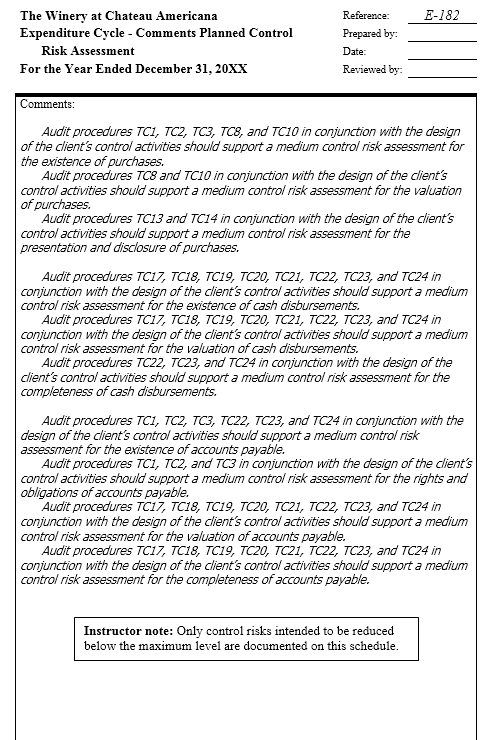

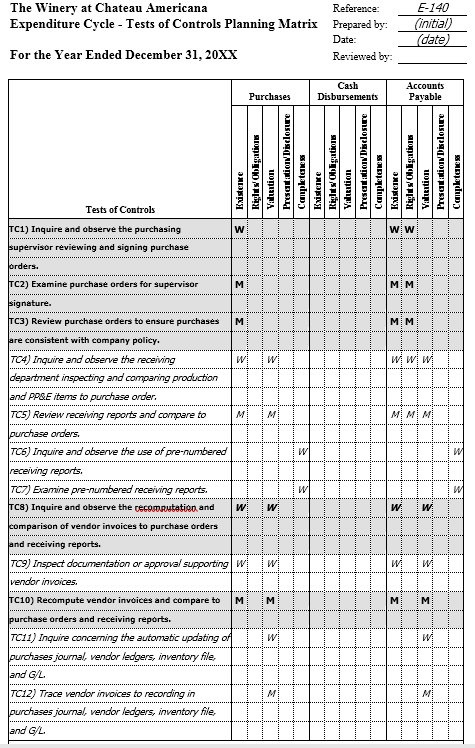

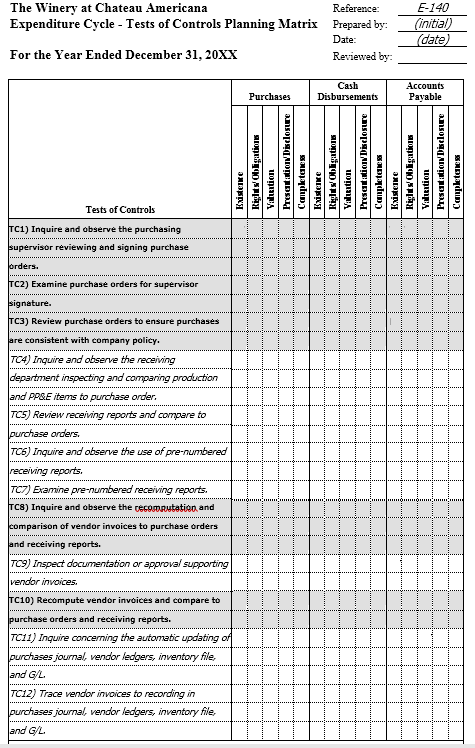

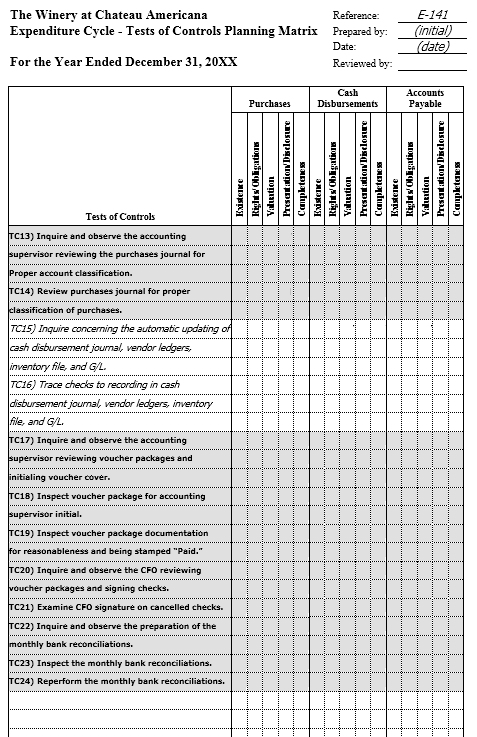

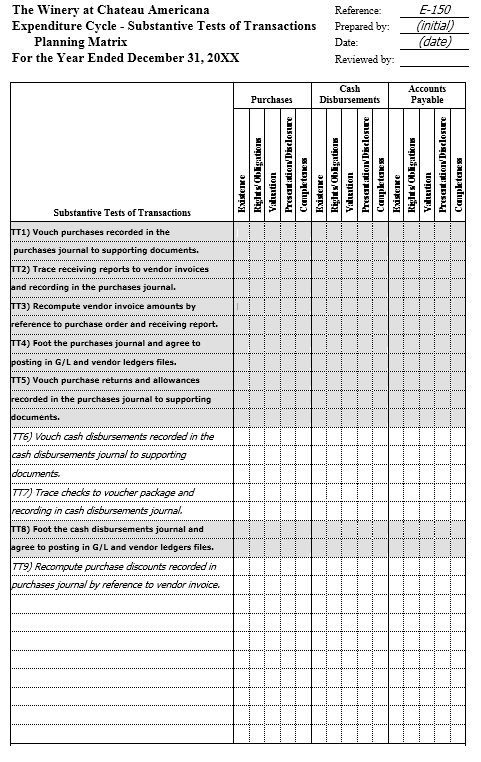

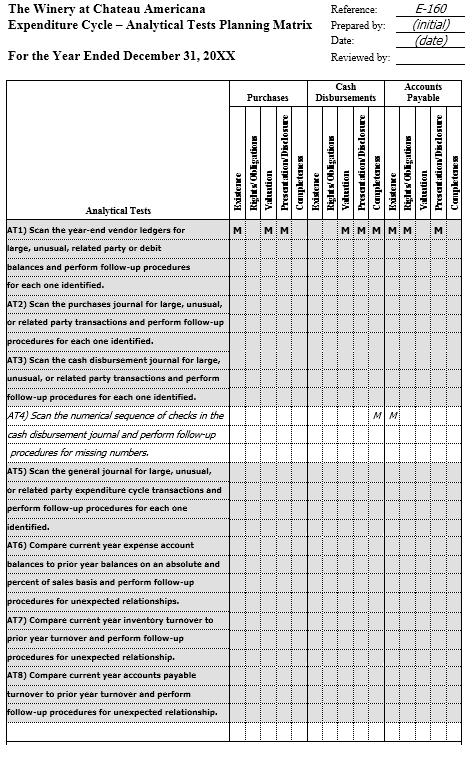

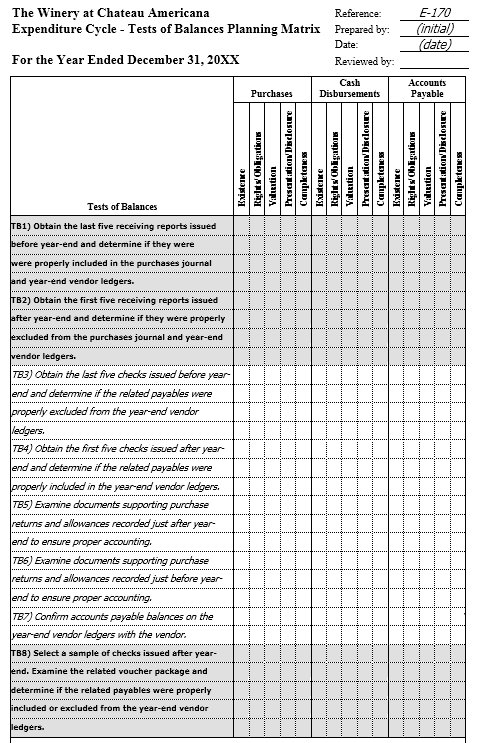

SELECTION OF AUDIT TESTS AND RISK ASSESSMENT FOR THE EXPENDITURE CYCLE (ACQUISITIONS AND CASH DISBURSEMENTS): The Winery at Chateau Americana

KEY FACTS

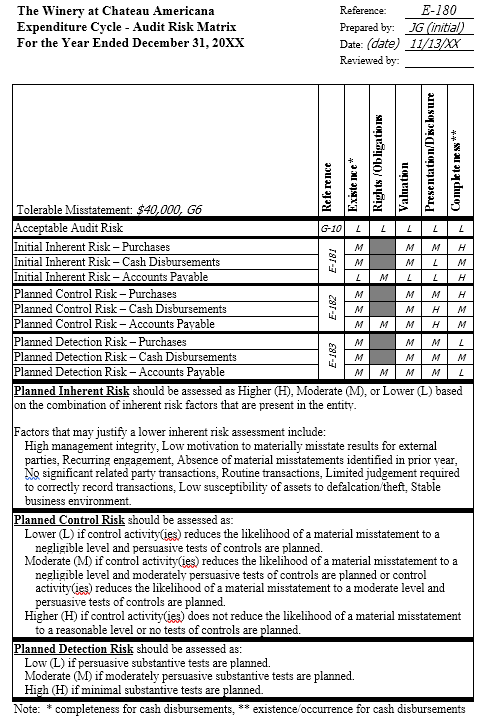

• The audit manager, Mikel Frucella, reviewed CA’s control environment, risk assessment policies, and monitoring system and assessed them as strong.

• The audit manager, Mikel Frucella, determined that tolerable misstatement should be $40,000 for the expenditure cycle.

• The audit manager, Mikel Frucella, determined that acceptable audit risk should be low

• A staff auditor, Julia Granger, assessed inherent risk related to purchases, cash disbursements, and accounts payable and prepared the inherent risk section of the audit risk matrix (referenced in the top right-hand corner as E-180 and E-181).

• Documents and records used to record purchase transactions include purchase requisition, purchase order, receiving report, vendor invoice, standardized chart of accounts, purchases journal, vendor ledgers file, and general ledger.

• Documents and records used with respect to cash disbursement transactions include voucher cover, signed check, bank statement, standardized chart of accounts, cash disbursements journal, vendor ledgers file, and general ledger.

• Receiving reports are only generated for production and PP&E purchases.

• Purchase orders are not generated for recurring services, such as utilities.

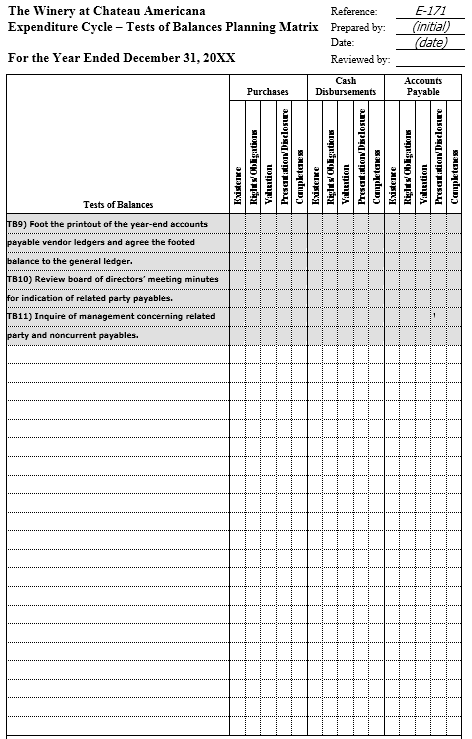

1.) Indicate whether the test provides Strong (S), Moderate (M), or Weak (W) evidence for the specific management assertion.

2.) Indicate whether the test provides Strong (S), Moderate (M), or Weak (W) evidence for the specific management assertion.

3.) Indicate whether the test provides Strong (S), Moderate (M), or Weak (W) evidence for the specific management assertion.

4.) Indicate whether the test provides Strong (S), Moderate (M), or Weak (W) evidence for the specific management assertion

5.) Indicate whether the test provides Strong (S), Moderate (M), or Weak (W) evidence for the specific management assertion.

6.) Indicate whether the test provides Strong (S), Moderate (M), or Weak (W) evidence for the specific management assertion.