According to the reports in Ponemon's 2014 Cost of Data Breach Study, organizations are more likely to lose larger amounts of data than smaller amounts of data

Indicate whether the statement is true or false

FALSE

You might also like to view...

A person in the ________ role will encourage all group members to participate.

A. compromiser B. commentator C. harmonizer D. encourager E. gatekeeper

Exhibit 22-3 Katrina Company acquired a truck on January 1, 2016, for $140,000. The truck had an estimated useful life of five years with no salvage value. Katrina used straight-line depreciation for the truck. On January 1, 2017, Katrina revises the estimated useful life of the truck. Katrina made the accounting change in 2017 to reflect the extended useful life. ? Refer to Exhibit 22-3. If

the revised estimated useful life of the truck is a total of seven years, and assuming an income tax rate of 35%, what is the amount of the prior-years effect that Katrina should report in its 2017 income statement as a result of changing the useful life of the truck? A) $0 B) $5,600 C) $16,800 D) $58,800

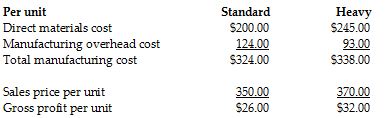

Compass Metal Bearings produces two sizes of metal bearings (sold by the crate)—standard and heavy. The standard bearings require $200 of direct materials per unit (per crate), and the heavy bearings require $245 of direct materials per unit. The operation is mechanized, and there is no direct labor. Previously Compass used a single plantwide allocation rate for manufacturing overhead, which was $1.55 per machine hour. Based on the single rate, gross profit was as follows:

Although the data showed that the heavy bearings were more profitable than the standard bearings, the plant manager knew that the heavy bearings required much more processing in the metal fabrication phase than the standard bearings, and that this factor was not adequately reflected in the single plantwide allocation rate. He suspected that it was distorting the profit data. He suggested adopting an activity-based costing approach.

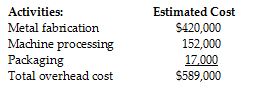

Working together, the engineers and accountants identified the following three manufacturing activities and broke down the annual overhead costs as shown below:

Engineers believed that metal fabrication costs should be allocated by weight and estimated that the plant processed 12,000 kilos of metal per year. Machine processing costs were correlated to machine hours, and the engineers estimated a total of 380,000 machine hours f

Contextual Forces Influencing Business Communication - Legal and Ethical Constraints ? Legal and ethical constraints are contextual forces influencing business communication. As contextual forces, legal and ethical constraints shape communication and provide boundaries in which communication occurs. Your understanding of legal and ethical constraints will improve the effectiveness of your workplace communication. True or False: Ethical business communication and decision making require that you consider only the position of stakeholders who are investors in publicly traded companies.

Indicate whether the statement is true or false