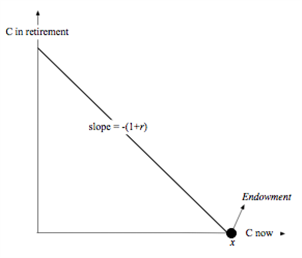

Suppose you own a stock portfolio composed of shares in firms that are part of the financial services industry. You don't work - all you do is plan your consumption now and when you retire, and the only asset you have is your stock portfolio. In this problem, model your decisions in a graph with "consumption now" on the horizontal axis and "consumption at retirement" on the vertical. Throughout, assume that the long run rate of return of investment is r over the period from now to retirement.

a. Graph your initial budget constraint - and indicate where in your graph your endowment point lies as well as what the slope of the budget constraint is.

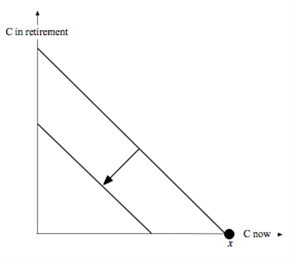

b. This morning, you woke up to find that the current financial crisis has wiped out some of the firms in your stock portfolio. As a result,

your portfolio is only worth half of what it was yesterday. Assuming that the long run rate of return r remains unchanged, what has just happened to your budget constraint?

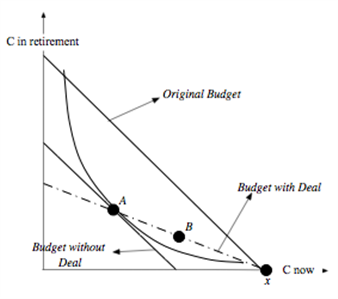

c. Assuming that consumption now and in the future is always a normal good, will you cut down on your consumption plans now?

d. Now suppose I offer you a deal: I will give you enough cash to raise your current (financial) wealth back to what it was yesterday, but in exchange you agree to give me half of any return in your investments when you retire. You carefully analyze the deal and calculate that, under this deal, you could in fact just afford to consume the same bundle (but not strictly more) as you would without the deal. Will you accept the deal?

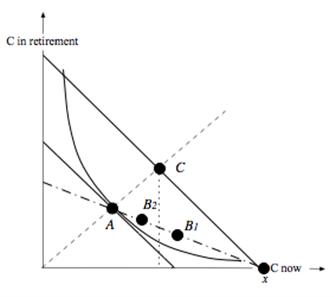

e. Does your answer to (d) depend on our assumption that consumption is always a normal good?

f. Can you tell whether, if you accept the deal, you will consume more than you otherwise would have? What does your answer depend on?

g. Can you tell whether, if you accept the deal, you consume more now than you had planned yesterday before the financial crisis wiped out half your wealth? What does your answer depend on?

What will be an ideal response?

c. This is a pure "income" change -- which means consumption now will fall (give that consumption is a normal good).

d. Yes, you will accept the deal since it makes bundles that lie above your current indifference curve available.

e. No -- it does not depend on whether or not consumption is normal.

f. You will definitely consume more now (at B) -- and this only depends on consumption across time being at least somewhat substitutable.

g. You might consume more or less now depending on how large the substitution effect is. We know in the graph how C and A are related (given the homotheticity of tastes). But B -- the point under the deal -- could lie to either side of C.

You might also like to view...

According to the government budget constraint, any excess of public expenditures and transfers over taxes and user fees must be funded by

A) private borrowing. B) government borrowing. C) U.S. Treasury money creation. D) Federal Reserve money creation.

Imposing a quota on metal softball bats shipped into the United States would likely:

a. increase the price of the bats but decrease the quantity of domestically made bats purchased in the United States. b. increase the price of the bats and the quantity of domestically made bats purchased in the United States c. leave the price of the bats unchanged but decrease the quantity purchased in the United States. d. leave both the price of bats and the quantity purchased in the United States unchanged.

A first-class Broadway musical typically costs how much to produce?

Answer the following statements true (T) or false (F)

1) The interest-rate effect is one of the determinants of aggregate demand. 2) The real-balances effect indicates that inflation makes the public feel wealthier and they therefore spend more out of their current incomes. 3) Other things equal, an increase in productivity will shift the short-run aggregate supply curve rightward. 4) In the immediate short run, both input and output prices are fixed. 5) An increase in wealth from a substantial increase in stock prices will move the economy along a fixed aggregate demand curve.