Gerald manages the marketing team in his company. Most of his team members are new to the organization. Which of the following practices would best help Gerald in building trust within his team?

A. Being judgmental when his team members share their ideas

B. Micromanaging his team members

C. Facilitating self-disclosure among his team members

D. Encouraging his team members to focus on self-protection

Answer: C

You might also like to view...

Balance sheet values are calculated using compound interest (present value) calculations for all of the following except

A) bonds payable. B) long-term notes receivable. C) long-term lease liabilities. D) deferred income taxes.

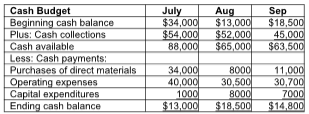

Subsequently, the marketing department revised its figures for cash collections. New data are as follows: $53,000 in July, $55,000 in August, and $46,000 in September. Based on the new data, calculate the new projected cash balance at the end of August.

Gunda Corp. has prepared a preliminary cash budget for the third quarter as shown below:

A) $20,500

B) $18,500

C) $12,000

D) $17,800

What type of organizations are affected by Executive Order 11246?

A. federal contractors receiving more than $10,000 per year B. state contractors receiving more than $50,000 per year C. private employers with 15 or more employees D. city governments with 50 or more employees

Effective January 2, 2014, Moldaur Co adopted the accounting principle of expensing advertising and promotion costs as they are incurred. Previously, advertising and promotion costs applicable to future periods were recorded in prepaid expenses. Moldaur can justify the change, which was made for both financial statement and income tax reporting purposes. Moldaur's prepaid advertising and

promotion costs totaled $250,000 at December 31 . 2013 . Assume that the income tax rate is 40 percent for 2013 and 2014 . The adjustment for the effect of the change in accounting principle should result in a net charge against income in the income statement for 2014 of a. $0. b. $100,000. c. $150,000. d. $250,000.