Consider a good to which a per-unit tax applies. The greater the price elasticities of demand and supply for the good, the

a. smaller the deadweight loss from the tax.

b. greater the deadweight loss from the tax.

c. more efficient is the tax.

d. more equitable is the distribution of the tax burden between buyers and sellers.

b

You might also like to view...

________ occurs when economic benefits are distributed fairly

A) Productive efficiency B) Equality C) Allocative efficiency D) Equity

Refer to Figure 15-10. Compared to a perfectly competitive market, consumer surplus is lower in a monopoly by an amount equal to the

A) area FGE. B) area FHE. C) area P1P2EF. D) area P1P2GF.

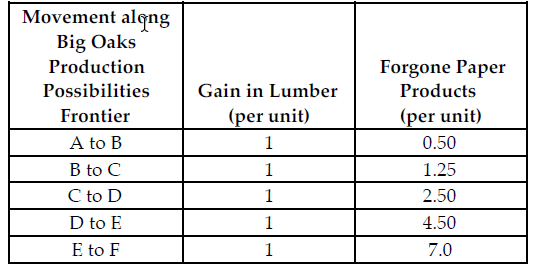

Refer to the table below. If the profit for each unit of paper product is $3.00 and the profit for each unit of lumber is $13.50, what is Big Oaks' marginal cost of producing between points B and C on their production possibilities frontier?

Big Oaks can produce either paper products or lumber with each tree that they harvest. Because Big Oaks can adjust the amount of paper products and lumber they produce from the harvested trees, paper products and lumber are produced in variable proportions. The above table summarizes Big Oaks production possibilities from each harvested tree.

A) $5.75

B) $3.75

C) $1.25

D) $7.50

Which of the following statements best describes a price ceiling?

(a) The maximum price that consumers will pay for a product/service. (b) A price ceiling will cause an excess demand for a good/service. (c) A price lower than the market equilibrium price. (d) All of the above.