Given a discount rate of 10 percent, the present value of receiving $100,000 two years in the future is

A. $12,000.

B. $82,645.

C. $121,000.

D. $80,000.

Answer: B

You might also like to view...

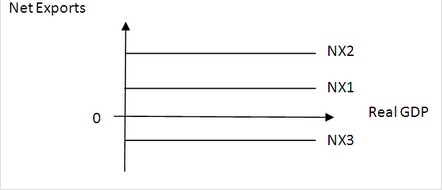

Use the following diagram to answer the next question. Suppose the economy currently can be described by NX3. What can we conclude?

Suppose the economy currently can be described by NX3. What can we conclude?

A. Both imports and exports are negative. B. Exports are negative and imports are positive. C. The value of exports exceeds the value of imports. D. The value of imports exceeds the value of exports.

The idea that creating incentives for individuals and firms to increase productivity leading to an increase in long-run aggregate supply is

A) the Ricardian equivalence theorem. B) demand-side economics. C) supply-side economics. D) consistent with crowding out.

If Intel moves first and makes a large investment in a chip fabrication plant in Bolivia in exchange for tax credits, Intel has made ________ and Bolivia ________

A) a tactical error; will nationalize the plant B) a specific investment; will create the tax credit C) a specific investment; has a hostage D) a general investment; no longer has to grant the tax credits

If Joe earns $80,000 per year and pays $20,000 in taxes, while Moe earns $100,000 and pays $22,000 in taxes, their tax system would best be described as:

a. progressive. b. proportional. c. regressive. d. discretionary. e. lump-sum.