List all the influences on selling plans, and for each influence, say whether it changes supply

What will be an ideal response?

Changes in the price of the good change the quantity supplied. They do not change the supply of the good.

Influences that change the supply of a good include:

• Prices of factor of production. A rise (fall) in the price of a factor of production increases firms' costs of production and decreases (increases) the supply of the good.

• Prices of related goods produced. If the price of a substitute in production rises (falls), firms decrease (increase) their sales of the original good and the supply for the original good decreases (increases). A rise (fall) in the price of a complement in production increases (decreases) production of the original good, causing the supply of the original good to increase (decrease).

• The expected future price of the good. A rise (fall) in the expected future price of the good decreases (increases) the amount suppliers sell today. This change in expectations decreases (increases) the supply in the current period.

• The number of sellers. An increase (decrease) in the number of sellers in a market increases the quantity of the good available at every price, and increases (decreases) the supply.

• Technology. An advance in technology increases the supply.

• The state of nature. A good (bad) state of nature, such as good (bad) weather for agricultural products, increases (decreases) the supply.

You might also like to view...

The most important difference between unit excise taxes and ad valorem excise taxes is _____

a. the unit tax will change in response to a change in the price of the taxed good, while the ad valorem tax will not b. the unit tax will not change in response to a change in the price of the taxed good, while the ad valorem tax will c. the unit tax increases in response to a change in the price of the taxed good, while the ad valorem tax will decline d. the unit tax declines in response to a change in the price of the taxed good, while the ad valorem tax will increase

Jill, a bookkeeper, just received an attractive offer from an outside firm and so she asks for a raise from her current employer. If the management of Jill's company is aware of the offer, she would

a. Have a weaker bargaining position b. Have a stronger bargaining position c. Be laughed at d. All of the above

Which of the following observations was made famous by Adam Smith in his book The Wealth of Nations?

a. There is no such thing as a free lunch. b. People buy more when prices are low than when prices are high. c. No matter how much people earn, they tend to spend more than they earn. d. Households and firms interacting in markets are guided by an "invisible hand" that leads them to desirable market outcomes.

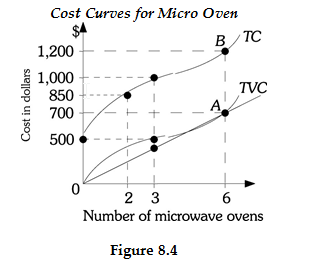

Refer to Figure 8.4. After Point A A) average total costs are increasing. B) marginal costs are decreasing. C) average variable costs are decreasing. D) average variable costs are increasing.