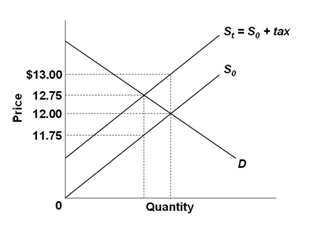

Refer to the below graph. It shows the supply curve for a product before tax (S0) and after an excise tax is imposed (S1). If 500 units of the product are sold after the tax is imposed, the amount of the tax borne by the consumer is:

A. $125

B. $250

C. $375

D. $500

C. $375

You might also like to view...

Assume that a 3% increase in income across the economy produces a 1% decrease in the quantity of fast food demanded. The income elasticity of demand for fast food is ________, and therefore fast food is ________

A. positive; an inferior good. B. negative; a normal good. C. positive; a normal good. D. negative; an inferior good.

The free rider problem causes goods not to be produced when

A) the opportunity cost of providing them is low. B) the quantity supplied is greater than the quantity demanded. C) they can't be produced by government. D) they can't be provided exclusively to the people who pay for them.

“Plowback” is a preferred source of financing a corporation because

A. the funds are easier to obtain, compared to issuing stocks. B. it is not subject to double taxation. C. selling bonds involves the high cost of money. D. stock markets are subject to random walks.

If price exceeds marginal cost, we say that a firm receives

a. Extraction surplus b. User costs c. Consumer surplus d. Royalty payments e. Resource rents