Explain how a distorting tax can improve efficiency when there are already present other taxes that distort decisions as well

What will be an ideal response?

By imposing a tax on one good when there are already distorting taxes on other goods this helps consumers face equal taxes on all goods. Therefore, they cannot avoid the tax by changing what they buy.

You might also like to view...

What are the differences between the four market structures in terms of the number of sellers in the market and the types of products produced?

What will be an ideal response?

Countries import some goods and export other goods primarily because of:

A) unemployment. B) self-sufficiency. C) comparative advantage. D) the law of increasing opportunity cost.

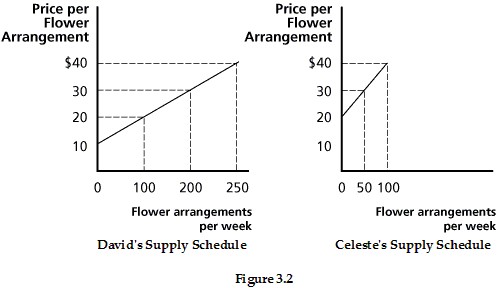

Refer to Figure 3.2, which shows David's and Celeste's individual supply curves for flower arrangements per week. Assuming David and Celeste are the only producers in the market, if the market quantity supplied is 350, the price must be:

Refer to Figure 3.2, which shows David's and Celeste's individual supply curves for flower arrangements per week. Assuming David and Celeste are the only producers in the market, if the market quantity supplied is 350, the price must be:

A. $10. B. $20. C. $30. D. $40.

Contractionary fiscal policy tends to ________ consumption because it may reduce ________

A. increase; disposable income. B. increase; savings. C. reduce; savings. D. reduce; disposable income.