Some policymakers have argued that products like cigarettes, alcohol, and sweetened soda generate negative externalities in consumption. If the government decided to impose a tax on soda, the government will cause

A) consumers to internalize the externality.

B) producers to internalize the externality.

C) the external cost to drinking soda to become a private cost paid by the government.

D) the external cost to drinking soda to become a private cost paid by producers.

Answer: A

You might also like to view...

If demand is unit elastic, then a 10 percent increase in the price will lead to a 10 percent increase in quantity demanded.

Answer the following statement true (T) or false (F)

If unemployment persists for a long period of time, the natural rate of unemployment rises

Indicate whether the statement is true or false

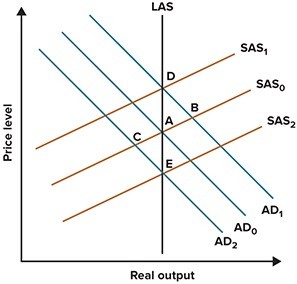

Refer to the graph shown. Suppose the economy is initially at A but then the Fed adopts an expansionary monetary policy. The initial effect of this policy will be pressure to move the economy to:

A. E. B. B. C. C. D. D.

Gross investment minus depreciation is equal to:

A. gross domestic product. B. net investment. C. personal investment. D. nominal investment.