Fiscal policy is

A) the money supply policy that the Fed pursues to achieve particular economic goals.

B) the spending and tax policy that the government pursues to achieve particular macroeconomic goals.

C) the investment policy that businesses pursue to achieve particular macroeconomic goals.

D) the spending and saving policy that consumers pursue to achieve particular macroeconomic goals.

E) none of the above

B

You might also like to view...

A bank finds itself short of required reserves and therefore borrows from another commercial bank. The interest rate on this loan is: a. zero

b. the prime rate. c. the discount rate. d. the federal funds rate. e. the required reserve ratio.

A progressive income tax means the percentage of income paid in taxes decreases as income increases

a. True b. False Indicate whether the statement is true or false

Governments can most effectively encourage a firm to produce the efficient level of output of a good whose production causes a beneficial externality by

a. increasing the demand at every price for the good. b. subsidizing the production of the good. c. taxing the production of the good. d. imposing a price ceiling on the good.

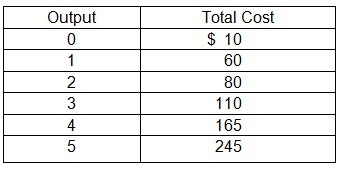

Total cost schedule for a competitive firm:  If market price is $60, how many units of output will the firm produce?

If market price is $60, how many units of output will the firm produce?

A. 3 units of output. B. 1 unit of output. C. 2 units of output. D. Zero units of output because the firm shuts down. E. none of the above.