Vince says that the present value of $500 to be received one year from today if the interest rate is 8 percent is more than the present value of $500 to be received two years from today if the interest rate is 4 percent. Terri says that $500 saved for two years at an interest rate of 3 percent has a larger future value than $500 saved for one years at an interest rate of 6 percent

a. Both Vince and Terri are correct.

b. Only Vince is correct.

c. Only Terri is correct.

d. Neither Vince nor Terri is correct.

a

You might also like to view...

If the real gross domestic product (GDP) for the base year is $4 trillion, then the nominal gross domestic product (GDP) for that year is _____

a. ?$.04 trillion b. $0.4 trillion c. $4 trillion d. $40 trillion e. $400 trillion

According to some economists, firms in some industries gain a performance advantage by: a. dumping

b. charging a zero price for products. c. clustering. d. reducing R&D spending. e. increasing labor wage.

If the dollar appreciates:

A. imports to the United States become more expensive for foreigners B. exports from the United States become more expensive for foreigners C. imports become more expensive for U.S. citizens. D. exports from the United States become cheaper

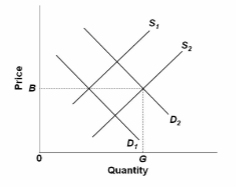

Refer to the competitive market diagram for product Z. Assume that the current market demand and supply curves for Z are D 1 and S 1 . If there are substantial external benefits associated with the production of Z, then:

A. government can improve the allocation of resources by subsidizing consumers of Z.

B. government can improve the allocation of resources by imposing a per-unit tax on Z.

C. a government subsidy for producers of Z would ensure that consumers are paying directly

for all of the benefits they receive from Z.

D. consumers are paying too much for the good.