Tax credits for new investment are likely to

A. Increase or decrease physical capital investment, depending on the magnitude of the tax credits.

B. Have no effect on physical capital investment.

C. Decrease physical capital investment.

D. Increase physical capital investment.

Answer: D

You might also like to view...

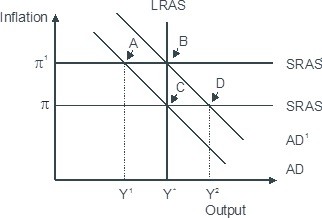

Based on the figure below. Starting from long-run equilibrium at point C, an increase in government spending that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ creating _____gap.

A. D; an expansionary B. B; no output C. B; expansionary D. A; a recessionary

Last year country A's residents purchased $700 billion of goods and services from and sold $500 billion of goods and services to residents of foreign countries. Its domestic investment was $1,100 . What was country A's saving? Show your work

Suppose Social Security contributions rise by $5 billion while Social Security benefits also rise by $5 billion. Further, personal income taxes fall by $700 million. As a result

A. disposable income should increase while personal income and national income are unchanged. B. both personal and disposable personal income should increase. C. national income, personal income, and disposable income should increase. D. personal income, disposable personal income, and national income remain unchanged.

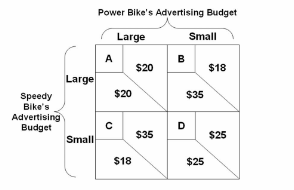

Refer to the payoff matrix. Suppose that Speedy Bike and Power Bike are the only two bicycle manufacturing firms serving the market. Both can choose large or small advertising budgets. Is there a Nash equilibrium solution to this game?

A. There is no possible Nash equilibrium solution.

B. A Nash equilibrium can occur at either cell B or cell C.

C. Cell A represents a Nash equilibrium.

D. Cell D represents a Nash equilibrium.