An imposition of tax by the government for funding welfare programs raises the cost of labor to firms as:

a. the demand for labor increases.

b. the demand for labor decreases.

c. the supply of labor decreases.

d. the supply of labor increases.

e. the opportunity cost of leisure increases.

c

You might also like to view...

Refer to Figure 6-10. A unit-elastic supply curve is shown in

A) Panel A. B) Panel B. C) Panel C. D) Panel D.

People are especially prone to undervaluing opportunity costs when

A. they are nonmonetary, such as time. B. they involve obvious costs, like lost wages. C. All of these are true. D. they are monetary.

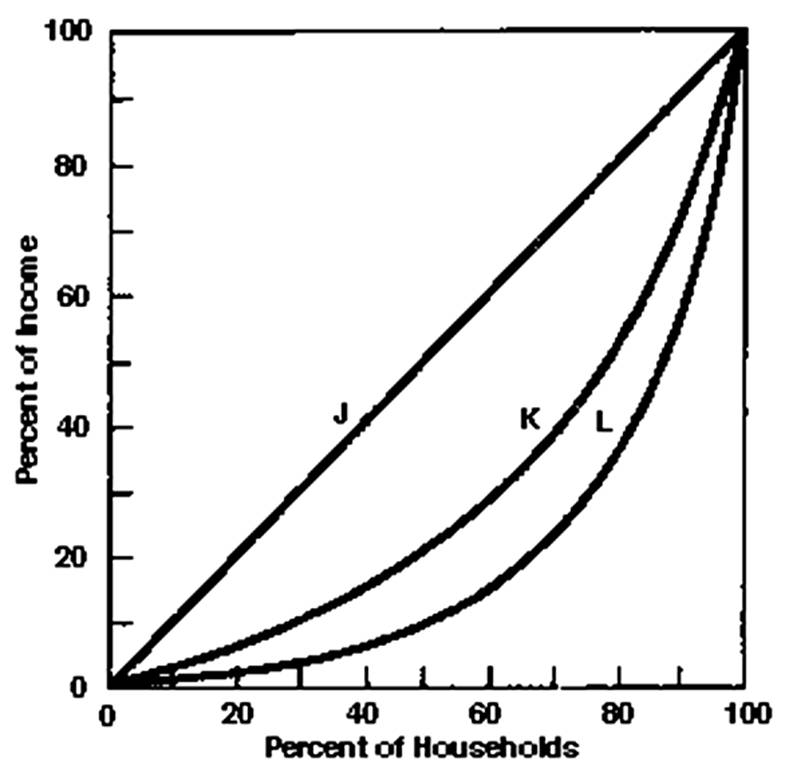

What is the percentage of income received by the upper quintiles on line L?

Which of the following does not explain why the command systems of the Soviet Union and Eastern Europe failed?

A. The failure to use money for most exchanges. B. Coordination problems. C. Prices and profits did not fluctuate to reflect wants for a different allocation of resources. D. Incentive problems.