How does investors’ preference for risk affect the slope of the security market line?

What will be an ideal response?

The more risk-averse investors are, the steeper the SML line will be. Investors will want more return for their risk taking if they are risk-averse. On the opposite end, if investors are less sensitive to changes in risk, the SML curve will be fairly flat, as large changes in risk don’t result in large changes in return.

You might also like to view...

Suppose you find $1000 in your attic and decide to deposit it all into your local bank, which must hold 20% as required reserves. The deposit expansion multiplier suggests that this $1,000 "injection" of new money will most likely

A) increase the money supply by a little more than $1,000. B) increase the money supply by a little less than $1,000. C) increase the money supply by only $1,000. D) increase the money supply by $5,000.

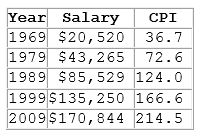

If the 1989 salary in 2009 dollars is $147,951, how do we interpret this?

A. The salary earned in 1989 could have purchased the same amount of goods as $147,951 could buy in 2009.

B. It would take $147,951 in 2009 to buy the same amount of goods that was purchased in 1989 with $85,529.

C. Someone earning $85,529 in 1989 would be as well off if he were earning $147,951 in 2009.

D. All of these interpretations are correct.

If unemployment benefits, payable for 26 weeks, became more generous it would be likely to _____ structural unemployment and _____ the natural rate of unemployment:

a. Not change; not change b. Not change; increase c. Increase; increase d. Increase; not change

Government failure occurs when government intervention fails to improve economic outcomes or makes them worse.

Answer the following statement true (T) or false (F)