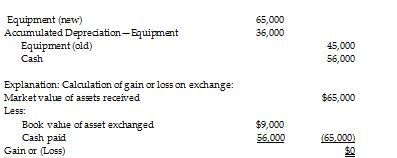

Journey Company purchased equipment for $45,000. Total depreciation of $36,000 was recorded. On January 1, 2017, Journey exchanged the equipment for new equipment, paying $56,000 cash. The market value of the new equipment is $65,000. Prepare the journal entry to record this transaction. Assume the exchange has commercial substance. Omit explanation.

What will be an ideal response?

You might also like to view...

In 2016, Valencia Company purchased equipment for $363,000 and also sold some special purpose machinery with a book value of $155,000 for $182,000 . In its statement of cash flows for 2016, Valencia should report the following with respect to the above transactions:

a. $363,000 cash used by operating activities; $182,000 cash provided by financing activities. b. $181,000 net cash used by investing activities. c. $181,000 net cash used by investing activities; $27,000 net cash provided by operating activities. d. $363,000 net cash used by investing activities.

If there are additional investments by the owner during the period, the balance sheet supplies all the necessary information to prepare the financial statements

Indicate whether the statement is true or false

A measurement process that determines the project goals and then the degree to which the actual performance lives up to these goals is:

A) A metric system. B) Goal-performance linkage. C) Five degrees of separation. D) Gap analysis.

Primary market transactions cannot be undertaken in over the counter markets

Indicate whether the statement is true or false