Assume Stock A has a standard deviation of 0.21 while Stock B has a standard deviation of 0.10. If both Stock A and Stock B must be held in isolation, and if investors are risk averse, we can conclude that Stock A will have a greater required return. However, if the assets could be held in portfolios, it is conceivable that the required return could be higher on the low standard deviation stock

Indicate whether the statement is true or false

True

You might also like to view...

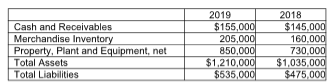

For the vertical analysis, what is the percentage of stockholders' equity as of December 31, 2019? (Round your answer to two decimal places.)

Modern Moving Company reported the following amounts on its balance sheet as of December 31,

2019 and December 31, 2018:

A) 100.00%

B) 54.11%

C) 55.79%

D) There is not enough information provided to make this computation.

Coca-Cola launched a series of TV commercials in 1995 aimed at testing the comparative advertising laws of 30 countries.

Answer the following statement true (T) or false (F)

The contribution margin format income statement classifies costs according to their behavior patterns.

Answer the following statement true (T) or false (F)

Cory is working on a global marketing assessment team looking out well into the future to help determine the most attractive market areas around the world. He is evaluating market sizes and growth rates. Based on population growth rates in different regions, he should consider that

A. in places like India, urban population centers will become increasing unattractive and the rural areas will experience major growth in population. B. the United States and Western Europe will have dramatic increases in population growth leading to overcrowding. C. the global population is expected to grow at staggering rates indefinitely. D. countries with high purchasing power today may not continue to show the same growth in the future. E. the middle class in India will continue to shrink as the rich get richer and the poor get poorer.