Solve the problem.Ray's gross pay is $321.20 a week. $46 is withheld for federal income tax, $24.12 for FICA tax, and $11.24 for other deductions. How much of his pay is left?

A. $402.56

B. $81.36

C. $229.84

D. $239.84

Answer: D

You might also like to view...

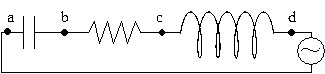

Solve the problem.The current in the circuit is 2.95 mA. Determine the voltage across the capacitor and the resistor (between a and c).XC = 2200 ?R = 2350 ?XL = 1150 ?  ? I

? I

A. V = 13.4 V B. V = 9.5 V C. V = 3.2 V D. V = 0.2 V

Use factoring to solve the equation.4x2 - 24x + 32 = 0

A. -2, -4 B. 0, 2, 4 C. 2, 4 D. 4, 2, 4

Find the Social Security tax and Medicare tax on the annual gross income of a self-employed individual. For a self-employed person, the FICA rate is 12.4% and the Medicare rate is 2.9%. Round to the nearest cent if needed.Larry Barnes, management consultant, earned $74,920.84

A. $9,190.18, $2,072.70 B. $4,645.09, $1,086.35 C. $4,645.09, $2,172.70 D. $9,290.18, $2,172.70

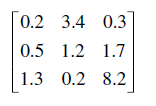

Find the determinant of the matrix and determine if the matrix is invertible

What will be an ideal response?