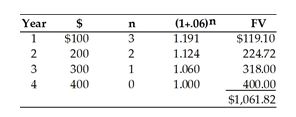

During her four years at college, Hayley received the following amounts of money at the end of each year from her grandmother. She deposited her money in a savings account paying 6 percent rate of interest. How much money will Hayley have on graduation day?

What will be an ideal response?

You might also like to view...

Which of the following is one of the "seven deadly sins of business selling"?

A. Strong product knowledge B. Unlimited optimism C. Timidity D. Thoroughness after the sale E. Over planning

In making a decision of whether to issue a loan to a consumer, an unsecured creditor may consider a number of factors. Which of these is NOT a factor that a creditor would normally consider?

A. the consumer's credit history B. the consumer's income C. the consumer's other assets D. the consumer's voting history

Ellen believes the value of the loss to her home is $30,000. The insurer has offered $18,000 to settle the loss

If Ellen and the insurer cannot agree on the value of the loss, which homeowners policy provision specifies how this dispute will be settled? A) insurer's option B) appraisal clause C) loss payment clause D) mortgage clause

Jeremy Ortiz is an employee of Insulor Flooring, where his job responsibilities include selling service contracts to customers. Jeremy is single with two withholding allowances. He receives an annual salary of $36,000 and receives a 3 percent commission on all sales. During the semimonthly pay period ending September 29, Jeremy sold $12,500 of service contracts. Complete the payroll register for

the September 29 pay period. What will be an ideal response?